Instagram influencer marketing is a great way for brands and businesses to reach engaged (and relevant) audiences.

But what is influencer marketing, how much does it cost, and why should it be part of your Instagram strategy?

We’re sharing everything you need to know to successfully find and work with influencers and creators, below.

Table of Contents

- What Is Influencer Marketing on Instagram?

- The Key Benefits of Instagram Influencer Marketing

- 5 Different Types of Influencers on Instagram to Partner With

- How to Find the Right Instagram Influencers for Your Brand

- How to Reach Out to Instagram Influencers

- How Much Do Influencers Charge?

- Tagging Sponsored Posts on Instagram

What Is Influencer Marketing on Instagram?

Instagram influencer marketing involves collaborating with influencers and creators to endorse and promote a brand's products or services on the platform.

It's an effective way to reach an engaged audience, introduce your brand, and jumpstart a relationship with potential customers.

FYI: Later Influence™ is an influencer marketing platform trusted by enterprise businesses to plan, grow, and manage their Instagram influencer partnerships. Learn more.

The Key Benefits of Instagram Influencer Marketing

From connecting with highly engaged audiences to making major sales, here are four benefits of Instagram influencer marketing:

Benefit #1: Say Goodbye to Sales-y Content

What makes influencer partnerships so powerful? One word: trust.

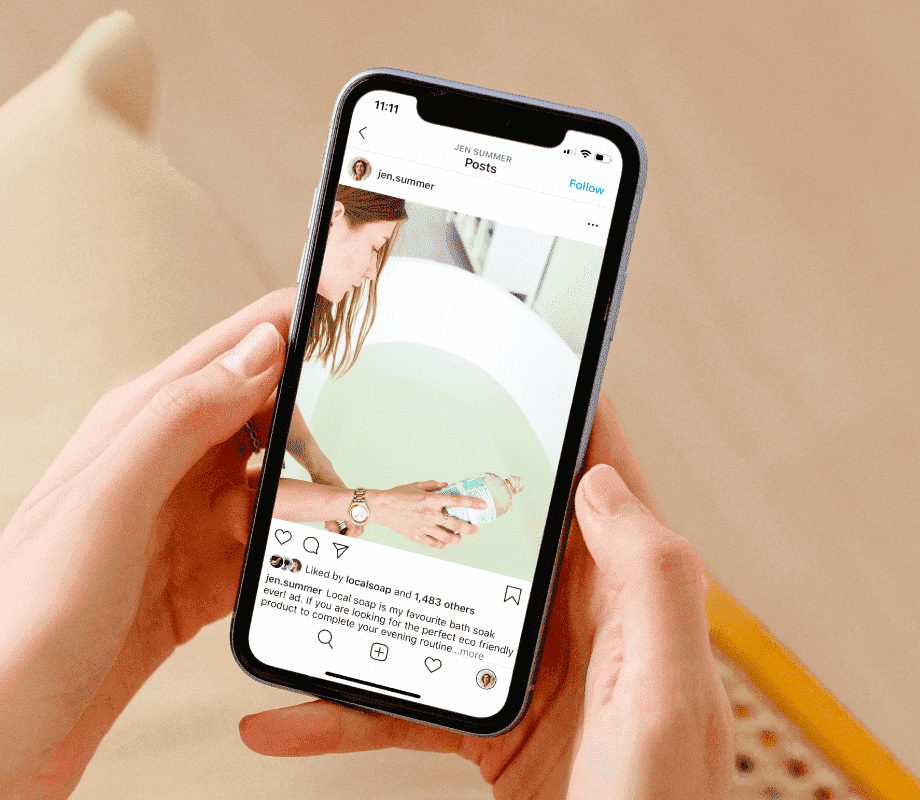

Influencer marketing removes the barriers of traditional advertising because users are introduced to your brand from a trusted source (the influencer) on an authentic, casual platform (Instagram).

When an influencer recommends a product or service in an Instagram post, Reel or story, it has the same effect as a vetted recommendation from a friend.

By collaborating with relevant influencers, your business is promoted to people who are interested in your niche, so it’s easier to make a real, lasting impression!

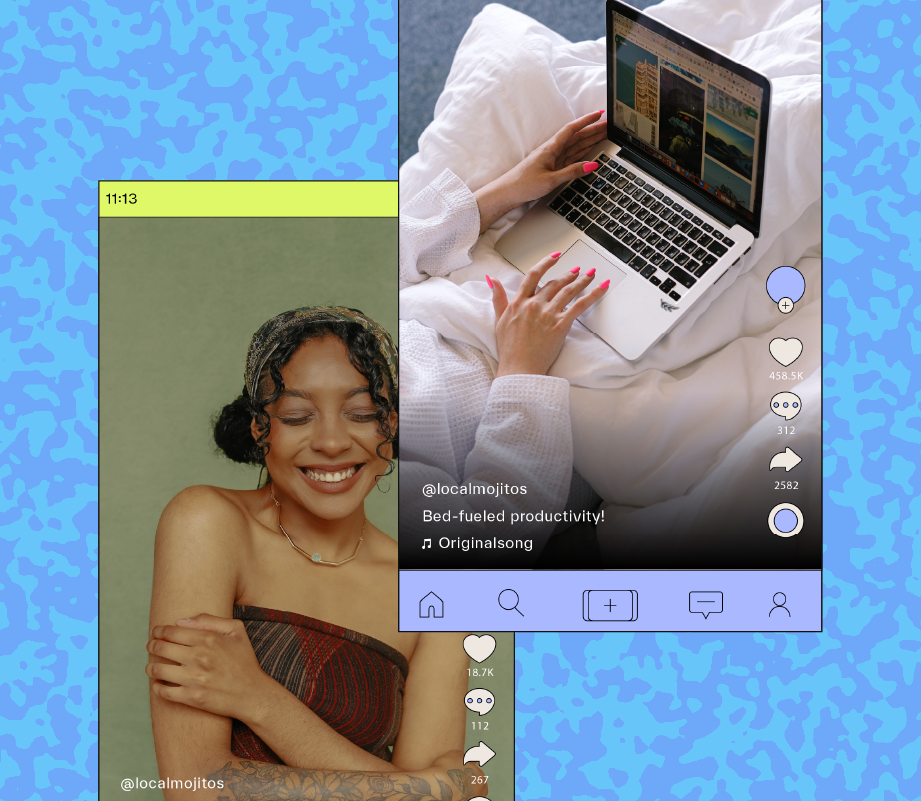

Benefit #2: Tap Into Highly Engaged Audiences

While engagement rates on Instagram have declined over the years, influencers — especially Nano and Micro influencers, still have solid engagement rates on the platform.

So, tapping into the audience they've grown can give you a serious boost in brand awareness and comments, shares, and clicks.

One way to do so? With a Collab post — which lets users co-author Instagram feed posts and Reels.

Just take a look at this collaboration between @tc.travels and Fairfax Off Grid Campers:

By partnering with influencers who have engaged communities within their niche, Fairfax is able to raise awareness of their camper vans directly to their target audience — without coming across as too promotional.

Benefit #3: Build Long-term Relationships

Research by Assemblo says “a person needs to see or hear an advertisement at least seven times for it to make a lasting impression.”

So, we recommend working with an influencer over a long period of time.

For example, when you think of mega influencer Tinx, you may automatically think of Tabasco:

The takeaway?

When you go the extra mile and build a strong partnership with a creator, you’re also building a strong relationship with their followers — win-win.

Benefit #4: Increase Sales

The influencer marketing industry is expected to reach a value of $22.2B by 2025.

So, teaming up with influencers and creators in your niche provides the perfect opportunity to make some serious coin.

Our advice? Run an influencer campaign for your next product launch like MAC Cosmetics did with their latest Hyper Real High-Performance Skincare line:

By partnering with multiple creators — Aysha Harun, Cyrus, and Amy Chang — the beauty brand leverages each influencer’s community to introduce their new skincare line and generate sales.

5 Different Types of Influencers on Instagram to Partner With

Influencers are commonly categorized into five different tiers based on their Instagram follower count:

Nano: 0K – 10K

Micro: 10K-100K

Mid: 100K – 500K

Macro: 500K – 1M

Mega Macro: 1M+

Each influencer tier has strengths and weaknesses, so deciding which is right for your next campaign can depend on several factors.

For example, Macro and Mega Macro influencers have gigantic audiences — making them a great choice for campaigns where mass awareness is key.

Their near-celebrity status can shift a brand’s perception by association alone.

However, this impressive social clout often comes at a cost — with the price of a sponsored Instagram post ranging from thousands to tens of thousands of dollars.

On the flip side, Nano and Micro influencers have a much smaller, but often more targeted, audience, making them a great choice for brands looking to create brand ambassador programs and tap into hyper-niche communities.

Ready to launch engaging influencer marketing campaigns for your enterprise brand? Schedule a call today to learn how.

How to Find the Right Instagram Influencers for Your Brand

The best partnerships will help you reach engaged audiences and build brand awareness.

So, how do you find the right influencers and creators for your next launch?

We’re sharing five steps to help you find your perfect match:

Step #1: Define Your Goals

Are you looking to build brand awareness? Drive sales? Generate more leads?

Think about how your collaboration will fit into your broader social media marketing strategy, and then set SMART goals.

Setting expectations in this stage will help you achieve your desired outcome down the road.

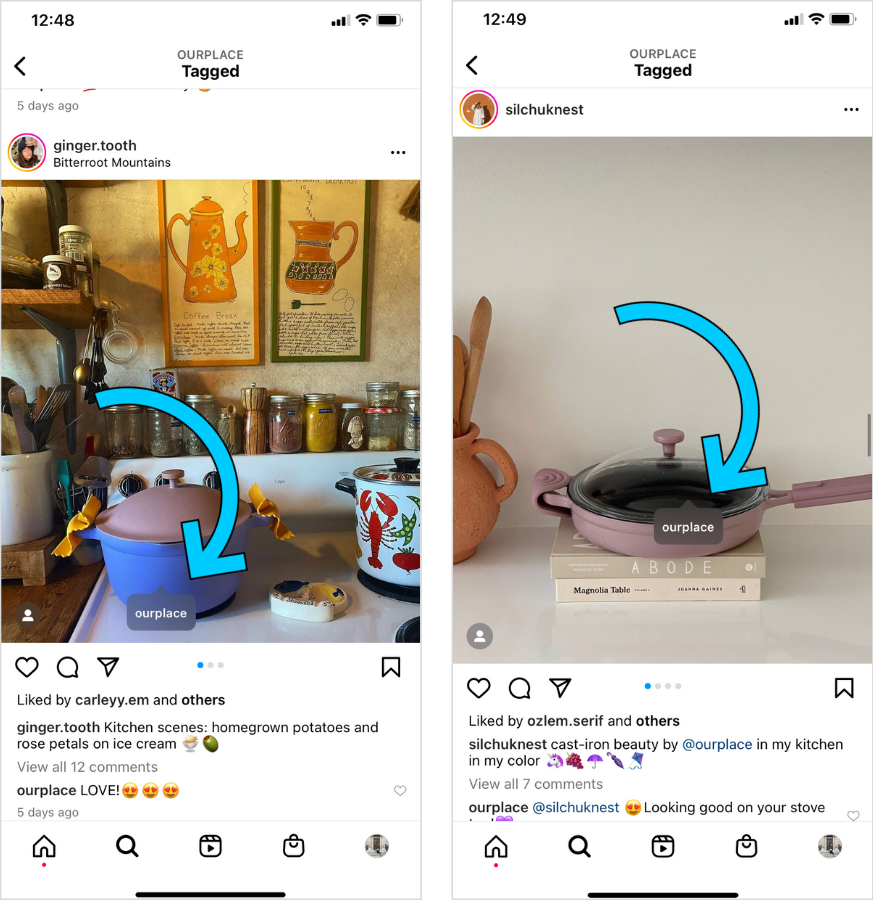

Step #2: Monitor Influencers & Creators Talking About Your Brand

Collaborating with the right people can be as easy as looking in your own backyard.

Set time aside to frequently monitor your tagged posts, comments, DMs, and branded hashtags to find influencers and creators who are already engaging with your brand.

"When you find influencers who are already talking about your brand, it makes it easier to reach out for a potential collaboration," says Later's Influencer and Partner Marketing Manager, Kurtis Smeaton.

"Of course, you'll need to vet them first. And if they're a brand fit, it'll make their endorsement more genuine," explains Kurtis.

Step #3: Look at Who Your Target Audience Engages With

Finding influencers that resonate with your target audience is an important step in the search process.

To do this, look at your existing community. Select anywhere from 10 to 15 followers who represent your target audience, and check out their following lists.

What type of creators are they already following? What’s their niche? Are you seeing any common trends in their content? How in line are they with your brand?

Step #4: Look at an Influencer & Creator’s Key Performance Metrics

Evaluating an influencer’s metrics is vital in determining if they'll help you reach your goals.

Once you find a creator you’re interested in, we recommend doing some digging before approaching them.

“Look through their followers and the comments on their posts,” says Kurtis.

“Are they full of bots? Spam accounts? This will help you gauge the genuineness of their community and engagement.”

As a best practice, scroll through an influencer’s previous posts, do a thorough Google search, and ask any contacts you have in the influencer marketing industry.

Step #5: Use an Influencer Marketing Platform

Finding the right partnership can feel like a full-time job without the right tools — but who said you have to do the heavy lifting?

Using a platform like Later Influence makes it easy to find creators and manage your partnerships in one place.

How to Reach Out to Instagram Influencers

Your first message to an influencer could make or break a partnership deal, so it’s worth putting in additional time to make sure you’re reaching out in the right way.

We have a few tips to help you get the right tone, message, and level of professionalism across:

Step #1: Research for Correct Contact Details

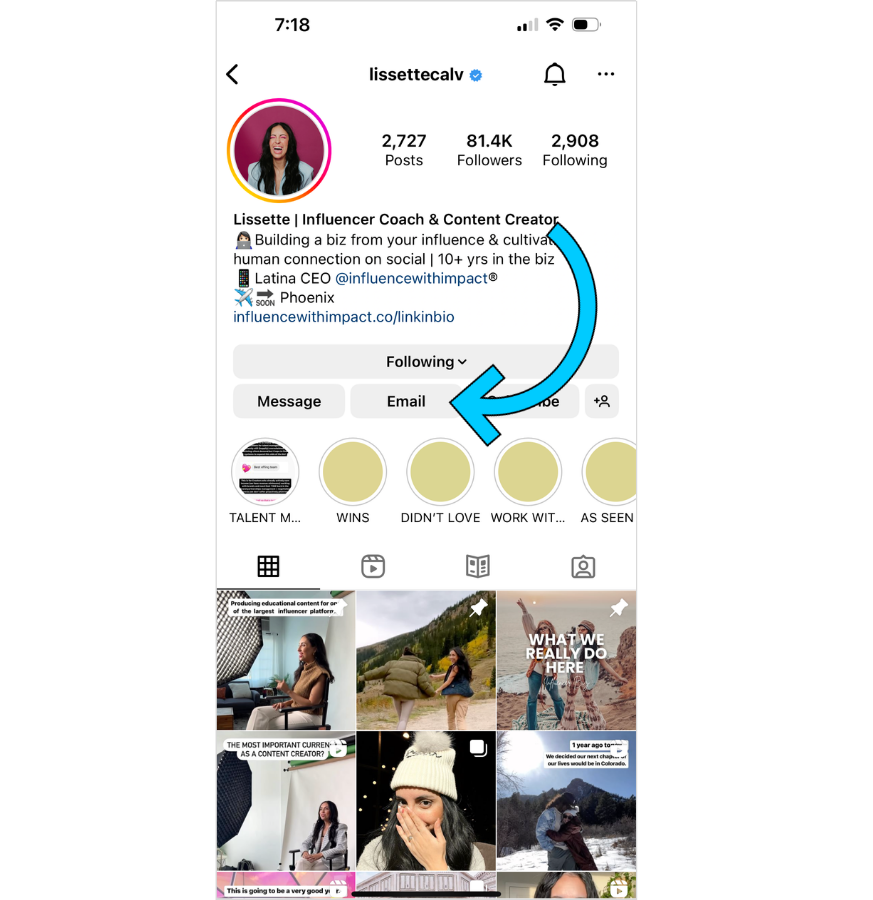

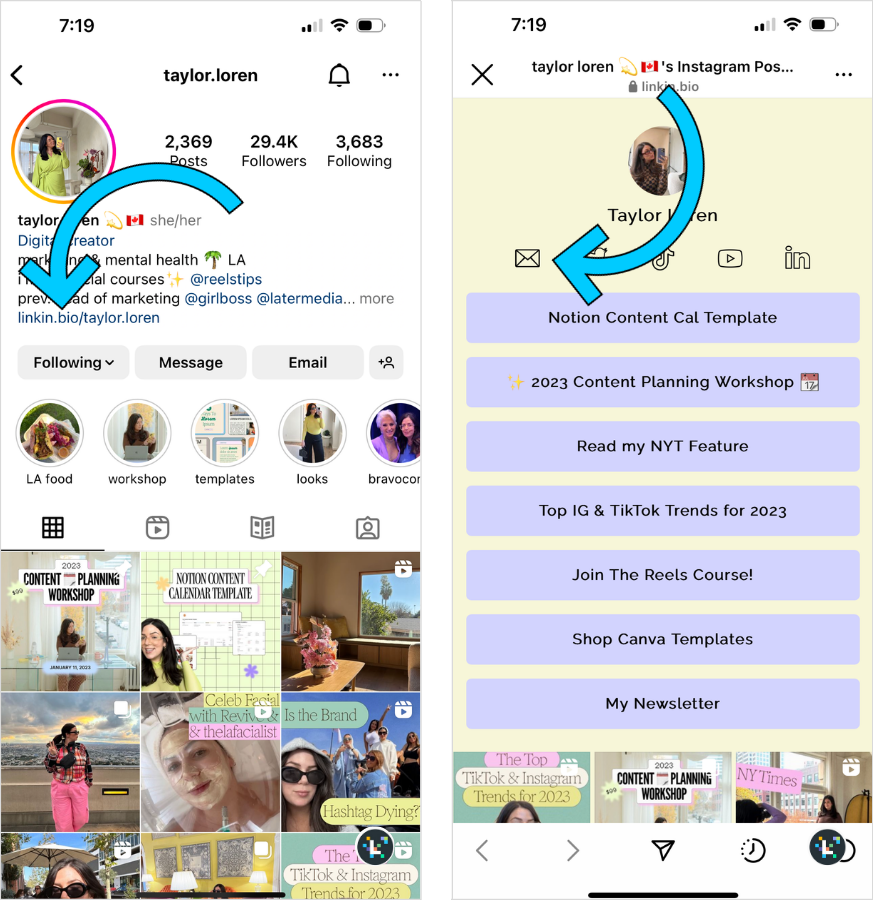

First, check if they have their contact information on Instagram.

All Instagram Business and Creator profiles can set up an email button from their profile, so you can email them directly from within the app:

If they don’t have this setup, many influencers have a link in bio page directing users to their website, or a contact form on their blog:

Step #2: Email Is Always Best for First Point of Contact

If you can source an email address for your influencer, we recommend sending them an email over any other kind of contact.

It’s professional, and lets you share more about your brand and campaign mission (more on that below).

If you can’t find an email, you can send a DM!

Just remember to always be professional, use their first name (rather than their Instagram handle as the greeting), and provide your email straight away as a point of contact.

TIP: You can connect with verified top creators in just a few clicks with Later. Learn more.

Step #3: Introduce Yourself, Your Role, and the Brand You Work For

Whether you’re the founder, CEO, marketing lead, or social media manager, make sure to introduce yourself.

That way, they’ll know exactly who they’re speaking to and may feel more confident asking questions about the future campaign.

Step #4: Talk About the Campaign & Why the Influencer Is a Good Fit

Remember to talk about the campaign (even if it’s still being fine-tuned!) and the direction the campaign is going in.

You’ll also want to mention why you think the influencer would be a good fit for your campaign.

Be as transparent as you can in your emails so everyone is clear on the project from the get-go.

Step #5: Negotiate Budget

Now that you’ve identified a few influencers you’d like to work with, it’s time to talk money!

Most influencers will provide a rate card or a media kit with rates included:

Keep in mind that rates can fluctuate — so be ready to negotiate a fee based on your budget and expected deliverables.

When the fee has been agreed upon, you’ll need to create a contract that includes all relevant information, including:

Payment: How much will they be paid? When will they be paid? Will there be other incentives aside from cash, like free products?

Briefing materials: Will you provide them with FAQs, descriptions of your products, and a caption guide?

Content deliverables: Will they be creating feed posts, Reels, Instagram Stories? How many?

Deadlines: When do they need to send their content for approval? When do they need to post their content?

Approval process for deliverables: How much feedback will you provide? What will the process be for approving their work?

Length of the contract: How long is the campaign or partnership?

Usage rights: Will you use their content for promotional purposes or on other platforms? How long will you use their content?

Exclusivity clause: Can they partner with a competitor during the campaign?

Endorsement Disclosures: How should they disclose your paid partnership?

Cancellation clause: What are the requirements for either party to terminate the agreement?

How Much Do Influencers Charge?

Since the influencer industry is still fairly new, there’s unfortunately no universal one-size-fits-all pricing rule.

For example, if you were to ask a content creator how much money they charge brands for sponsored posts, you may be surprised to see a scope of answers across the board:

That said, many digital marketers adhere to a $250-$450 per 10K followers rule, as a starting point.

Creator rates should also consider:

An influencer’s reach and engagement: The higher the engagement rate, the more they'll charge.

The type of content included in the scope of work: An Instagram Reel or carousel may cost more than a standard feed post.

The amount of time and resources required to create content: This includes setting up shots, possible outfit changes, script writing, etc.

The length of the campaign: How often is the influencer expected to post about a product or service?

Usage rights: This includes rights to repurpose content for a brand’s site, ads, or other platforms.

Speaking of pay transparency, Later's Creator Rates Report covers everything you need to know about creator compensation — from creators themselves.

Tagging Sponsored Posts on Instagram

When it comes to Instagram influencer marketing, it’s important that both parties are on the same page about how to disclose sponsored Instagram posts.

As a brand, it’s your responsibility to ensure that you are FTC compliant — here are five rules for properly disclosing a sponsored Instagram post:

Rule #1: Place Your Disclosure So It’s Hard to Miss

The first rule of a sponsored post is to make sure the disclosure is instantly obvious to anyone who engages with the content.

For example, if you or an influencer is sharing a sponsored feed post, the disclosure should be clearly visible in the first few lines of the caption — not buried amongst hashtags or hidden amongst text.

For video content, the disclosure should be included in the video itself as well as in the video description.

The reason? According to the FTC, some viewers may watch without sound and others may not notice superimposed words.

Rule #2: Use Simple and Clear Language

Now that we’ve covered where a disclosure should live, what actually counts as a fair and clear “disclosure”?

Well, the latest advice from the FTC is that a simple explanation, such as: “Thanks to [insert brand] for the free product,” is often enough.

Equally, terms like “advertisement,” “ad,” and “sponsored,” are acceptable so long as they are clearly visible to anyone who engages with the sponsored content.

The most important thing is to ensure the disclosure is crystal clear and isn’t open to any misinterpretation.

Stay away from vague or confusing terms like “sp,” “spon,” and “collab,” or stand-alone terms like “thanks” or “ambassador.”

Rule #3: Use the Same Language Throughout

It may seem like a given, but it’s important that the disclosure is in the same language as the endorsement itself.

For example, if a caption about a partner brand is written in German, your disclosure explanation should be in German too.

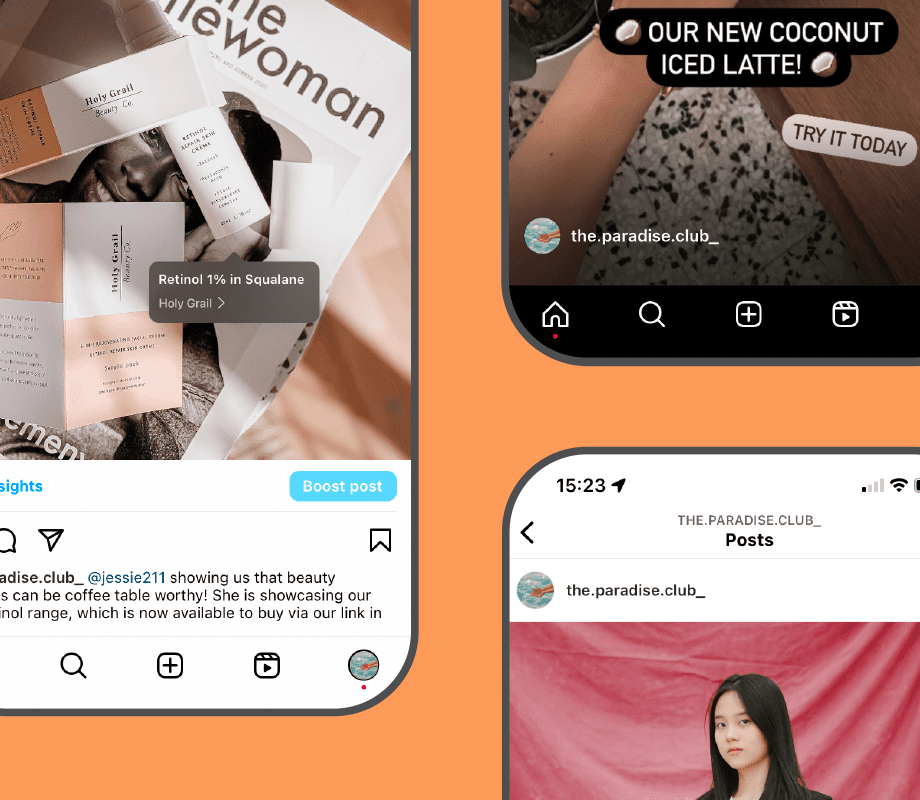

Rule #4: Don’t Assume a Platform’s Disclosure Tool is Good Enough

ICYMI: Instagram has brand partnership labels for sponsored content:

According to the FTC, however, these built-in tools might not be good enough.

Their advice is to use these tools as well as your own clear and accurate disclosure.

Rule #5: Share Honest Endorsements Only

Last but not least, it’s important that the influencers you partner with are giving fair and honest endorsements — even when the partnership is fully disclosed.

For example, influencers shouldn’t talk about their experience with a product or service they haven’t tried.

Equally, influencers should never make claims that would require proof the advertiser doesn’t have, such as scientific proof that a product can treat a health condition.

And there you have it — our ultimate guide to Instagram influencer marketing to grow your business.

Whether you’re gifting a product or paying an Influencer for sponsored posts, brands of all sizes can harness the power of Instagram influencer marketing to reach new audiences and drive serious sales!

Ready to elevate your marketing strategy with Later's influencer marketing solutions? Schedule a call to get started, today.