Are you getting the most out of your Pinterest marketing strategy?

There are over 367M+ users searching and sharing inspiration on Pinterest every month — that’s a huge, engaged audience with real purchasing power!

So if you’re not seeing results from your efforts, now’s the time to knuckle down and invest in your Pinterest marketing strategy.

Ready to get started? Here’s our Ultimate Guide to Pinterest Marketing:

Table of Contents:

The Power of Pinterest Marketing for Business

With the right strategy, Pinterest can be a super-powerful tool for your business.

You can build a strong community that engages with your content, drive brand awareness, click-throughs, and ultimately product sales.

But what sets Pinterest apart from other social networks? And why should your business be investing time and effort into Pinterest marketing?

Let’s jump right in to why Pinterest marketing is such a powerful asset for your brand:

Pinterest Power #1: Pinterest is a Visual Search Engine

Pinterest isn’t just a social network — it’s a visual search engine!

This means that your content can be discovered by almost anyone searching on Pinterest at any time — giving your content a much longer shelf-life than on Instagram, Facebook, Twitter, and beyond.

Most businesses still think of Pinterest as just a social channel, and they’re seeing subpar results because of it.

But by optimizing your Pinterest marketing strategy for views and saves, rather than likes and comments, you can achieve so much more for your brand.

We’re going to be giving you the rundown on exactly how you can optimize your Pins in this post — stay tuned!

Pinterest Power #2: The Pinterest Demographic

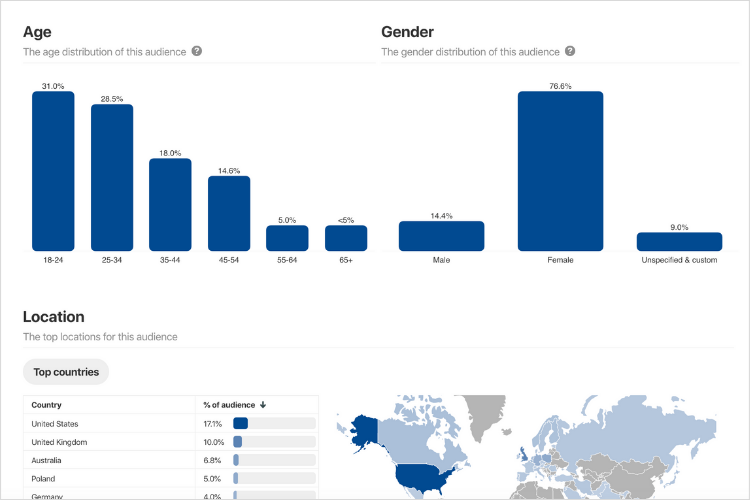

Pinterest’s demographic is unlike any other social platform.

According to Pinterest, the platform reaches 77% of all women 25-54 in the US. And, as the global income of women reaches trillions of dollars, women are expected to control almost 75% of discretionary spending worldwide by 2028.

And what’s more, we know that people actively use Pinterest as a platform to inform their purchasing decisions.

According to Pinterest, 84% of weekly Pinners use Pinterest when actively considering products/services to purchase but are undecided

So with the right Pinterest marketing strategy, you’ll be targeting people who have both spending power and intent to purchase.

Pinterest Power #3: A Longer Shelf Life

In comparison to most other social platforms, the content you share on Pinterest has a much longer shelf life.

When you first create a Pin, the chances are that you won’t be inundated with likes and comments. Instead, over time, your Pins will be discovered through search. And if you’ve nailed your Pin strategy, they’ll gradually be saved again and again, spreading across the Pinterest community.

This slow-burn strategy might not provide the instant return you’re familiar with on Instagram or Facebook, but it does mean that a single Pin can still be driving fresh brand awareness months — if not years — down the line.

One of the best ways to bump up your long-term brand awareness is to create and save content consistently on your Pinterest account. Thankfully, this is easy to do if you use a visual content planner and scheduler like Later.

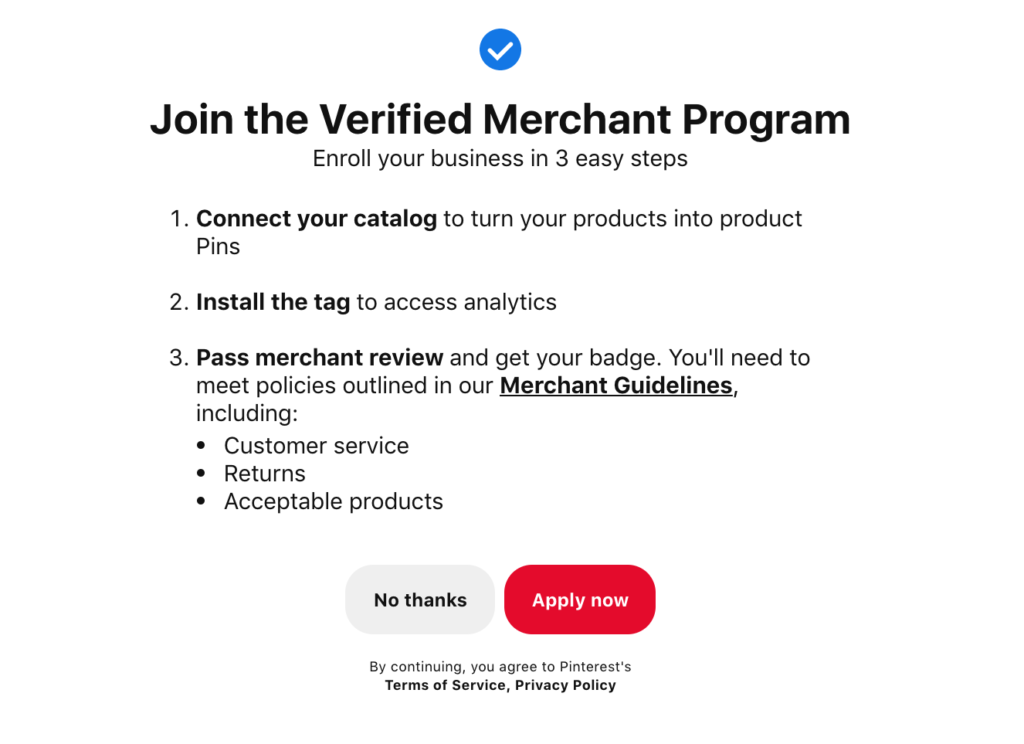

**Pinterest Power #4: Become a Verified Merchant

**

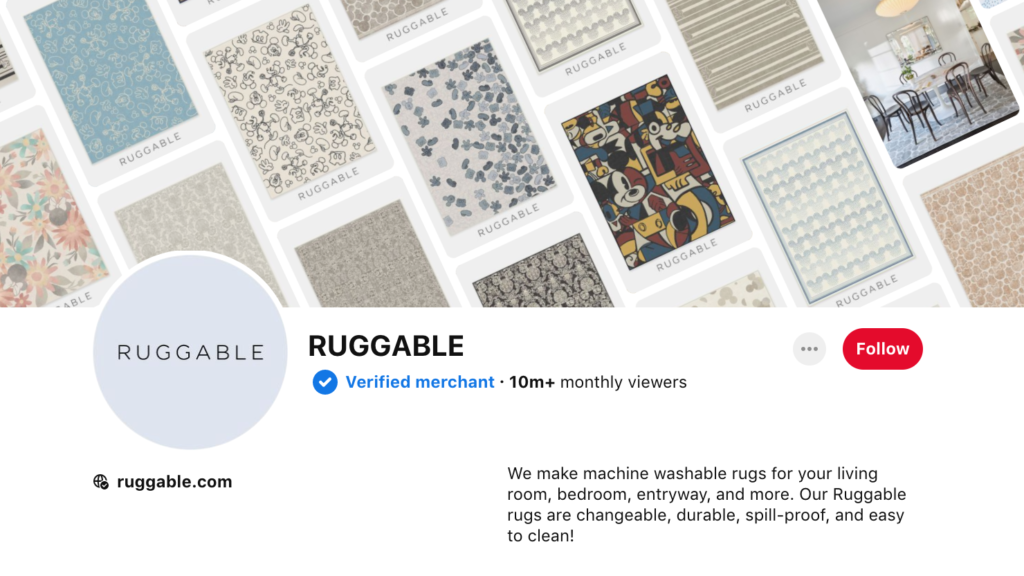

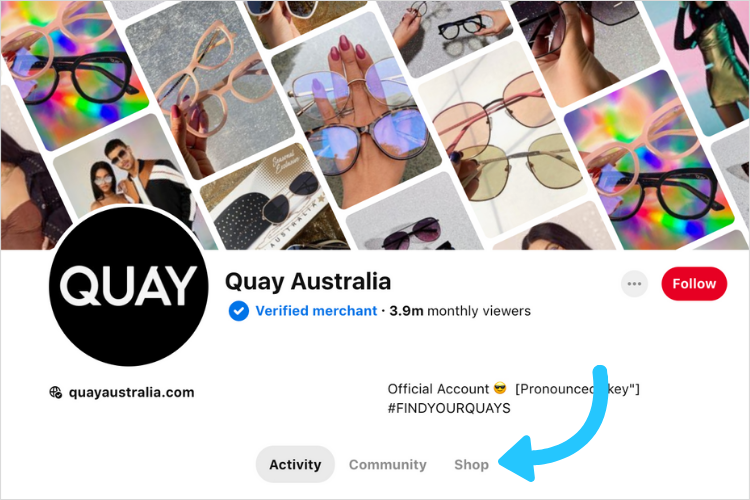

Similar to the blue tick on Instagram, Pinterest users will now start to see a blue checkmark on select merchant accounts! Displayed next to the account name, the blue tick represents businesses that are in Pinterest’s new Verified Merchant Program.

This program aims to help businesses increase their sales and help Pinners discover and shop from Pinterest-vetted brands. Companies like Quay Australia, Ruggable, and Coyuchi are a few of the first on board.

Any merchant can apply, but to be eligible you must meet Pinterest’s community guidelines and have a digital footprint online — not just on Pinterest! They’re looking for businesses with high-quality products, customer service, and websites.

The program comes with more benefits than one! Once you’re a verified merchant on Pinterest, you’ll have early access to new measurement and analytics tools — including organic and paid conversion insights so you can measure Pinterest’s impact.

You’ll also have a Shop tab on your profile! This new tab on your page is where shoppers can click in and directly see the products you sell.

Plus, items will appear in Pinterest’s shopping experiences like in the related products section — in front of people who are searching for new brands!

If you’re interested in becoming a Verified Merchant on Pinterest, you can apply here.

Pinterest Power #5: Get More Traffic from the Shop Tab

With the rising demand for shopping on the app, Pinterest has introduced a Shop tab — a new tab where users can search and browse in-stock inventory from retailers!

Before, all shoppable Pins were thrown into the mix of things, but now, in-stock items can be found under the Shop tab making it much easier to get more traffic to your Pins.

For example, when users search “summer outfits” or “at home workspace” the Shop tab will show in-stock items that relate to those keyword searches.

According to TechCrunch, the number of Shoppable Product Pins has increased by 2.5 times since last year, and Pinterest drove a total increase in traffic to retailers by 2.3 times since last year. And, according to Pinterest, 97% of Pinterest users’ searches are unbranded — meaning most people are searching for ideas, rather than specific brands.

The Shop tab is an awesome addition for both Pinterest shoppers and retailers. If you’re a retailer, you can leverage your Product Pins even further, and if you’re a shopper, you’ll see a much more streamlined shopping experience.

Alongside the Shop tab on Verified Merchant’s profiles, there are 4 additional ways Pinterest makes the shopping experience easier for both shoppers and retailers.

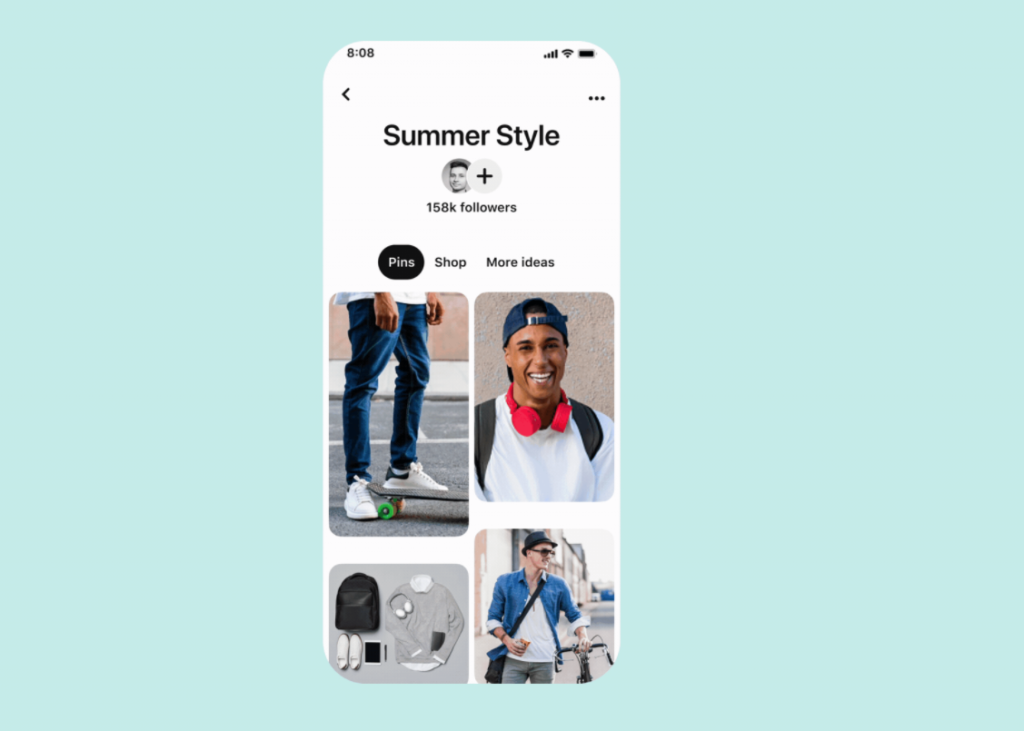

#1: Shop Tab on Pinterest Boards

When a user is browsing a Pinterest board, the new Shop tab will show products inspired by or from Pins they’ve saved to their boards. Users will see in-stock products based on what they’ve been saving — think of it as a virtual shopping wishlist.

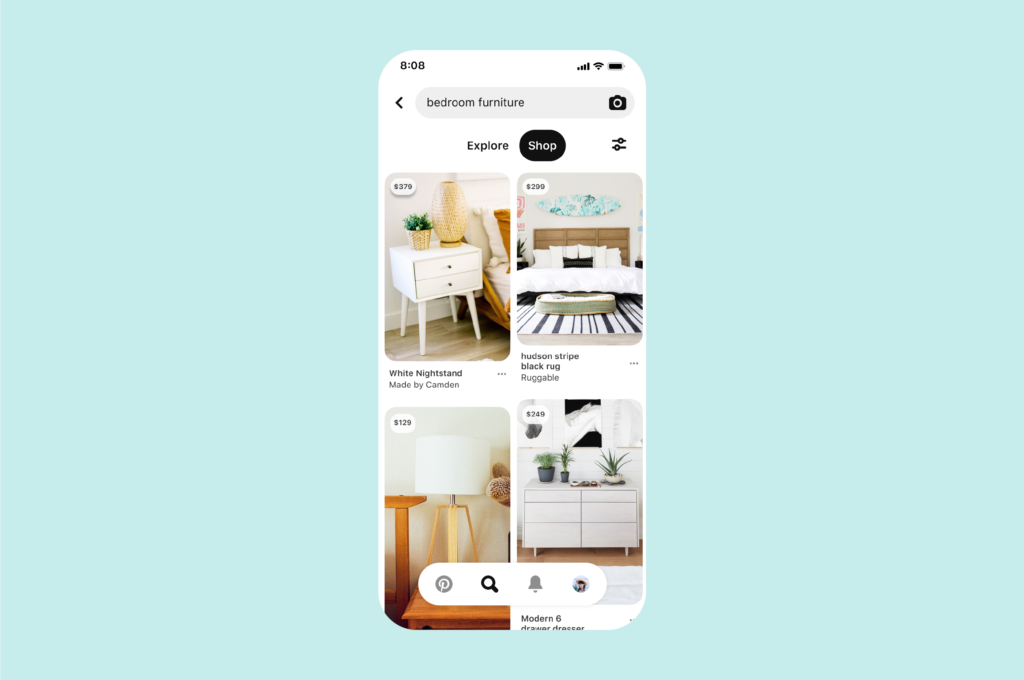

#2: Shop Tab in Search Results

When searching on Pinterest, you’ll see a new Shop tab in the search results. For example, when searching for things like “summer outfits”, ��“open concept kitchen”, or “round sunglasses”, you’ll see a range of in-stock products from retailers.

#3: Shop from Pins

Pinterest has made it easy to shop directly from a Product Pin — just press “shop similar” and you’ll see in-stock products from related retailers.

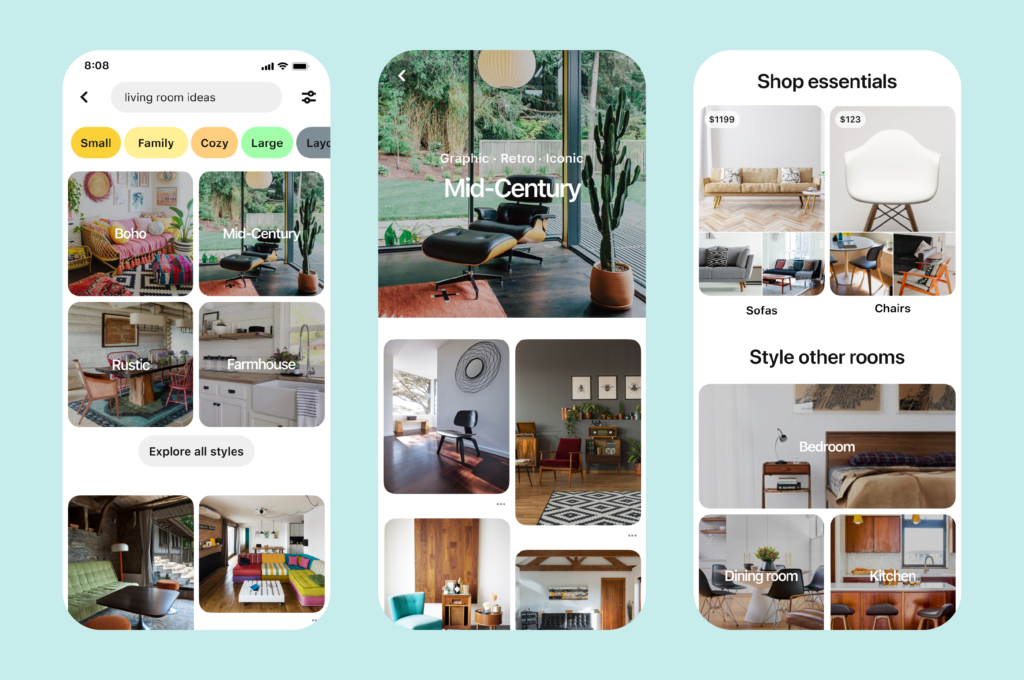

#4: Shop Tab in Style Guides

When you search a home-related term like “bathroom ideas”, Pinterest curates browsable style guides for you to search (and shop) through.

According to Pinterest, these visual recommendations make it easier to explore trending styles even if you don’t have the words to describe what you’re looking for. And now, there’s a Shop tab integrated to help you recreate the look.

NOTE: This feature is currently only for “home decor” themed searches.

With Pinterest’s new shopping features and the right marketing strategy, you’ll be targeting people who have both spending power and intent to purchase.

If you’re a retailer on Pinterest and you’re not incorporating Product Pins in your strategy, now is a great time to get started!

As a Pinterest Partner, Later offers exclusive features to help you grow your business on Pinterest. Start planning and scheduling your Pins with Later now!

How to Create Successful Pins for Your Brand

Taking into account that Pinterest is a visual search engine, it’s important to create original Pins that stand out from the crowd!

So to help you get going, here are some best practices to ensure your Pins are at the very top of their game.

How to Create Pins Tip #1: Create Branded Content That’s Tailored to Your Audience

The more entertaining, valuable, or relatable your Pins are, the greater the likelihood that people will save them to their own Pinterest boards — which means more exposure for your content!

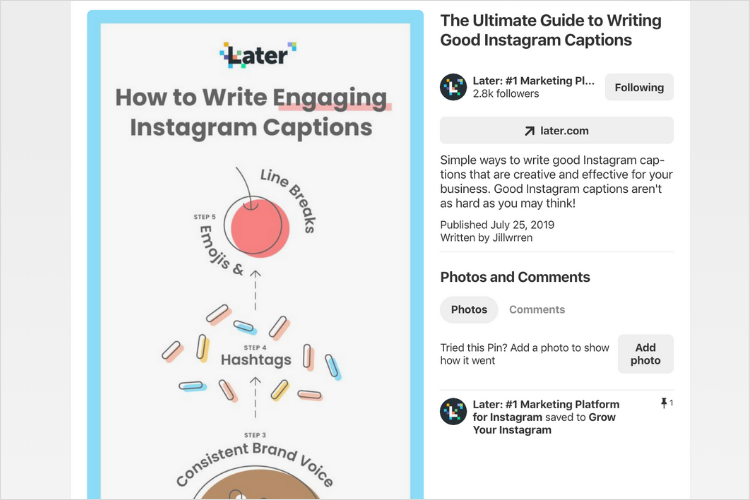

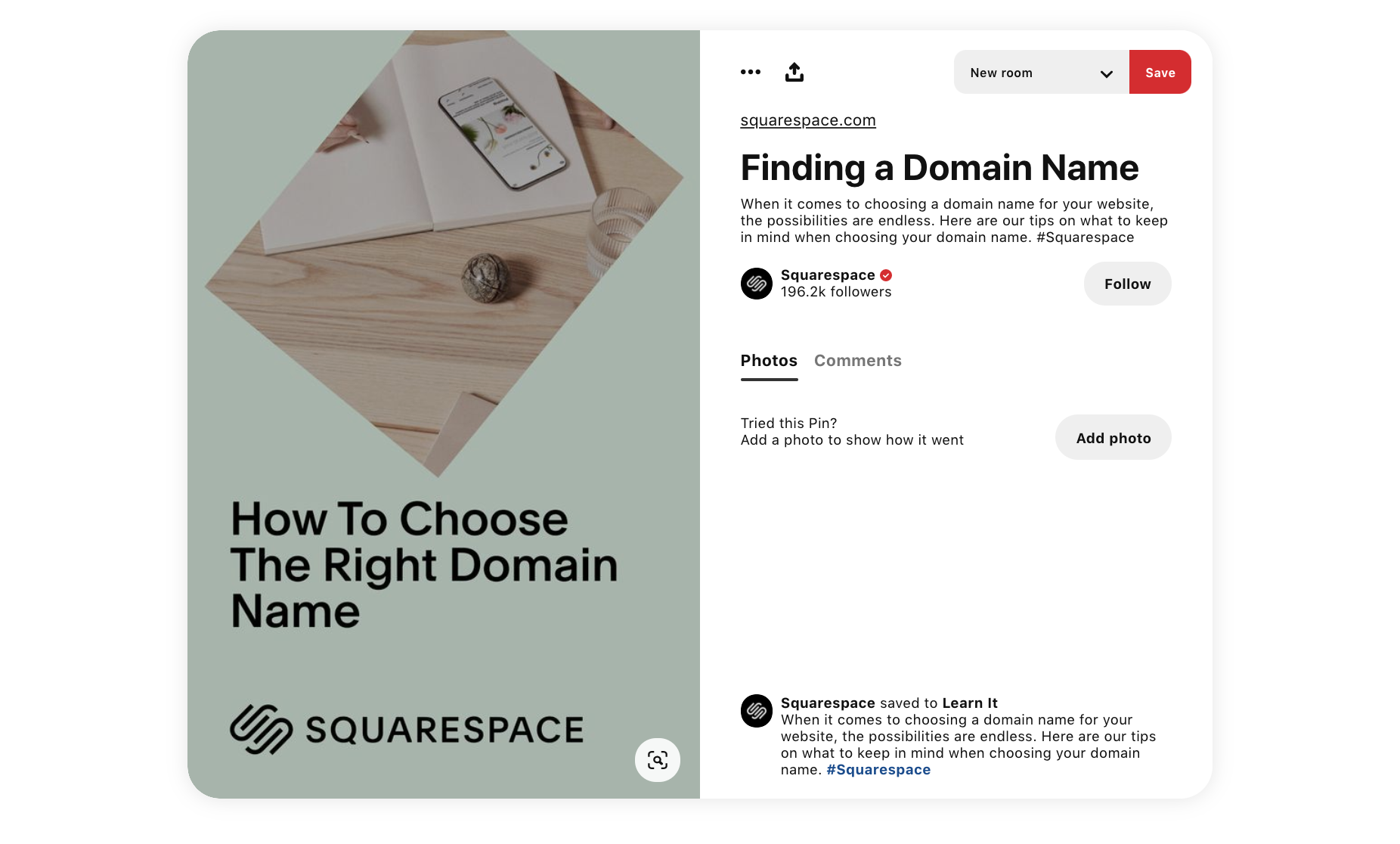

At Later, we create Pins that provide value to our target audience of brand managers. We use our brand logo, colors, and fonts, so our Pins are instantly recognizable wherever they’re saved.

How to Create Pins Tip #2: Maintain a Consistent Aesthetic

Whatever content you decide to share on Pinterest, it should be clearly recognizable as an extension of your brand.

Having a strong Pinterest aesthetic is one of the best ways to build a following and show off your brand’s unique style and tone.

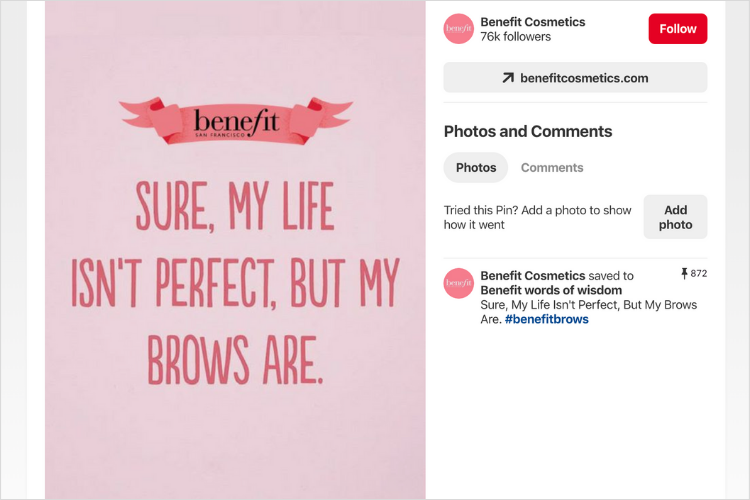

Check out how beauty brand Benefit uses a consistent pink color palette and uniform fonts to create instantly recognizable Pins.

How to Create Pins Tip #3: Provide Extra Detail With Rich Pins

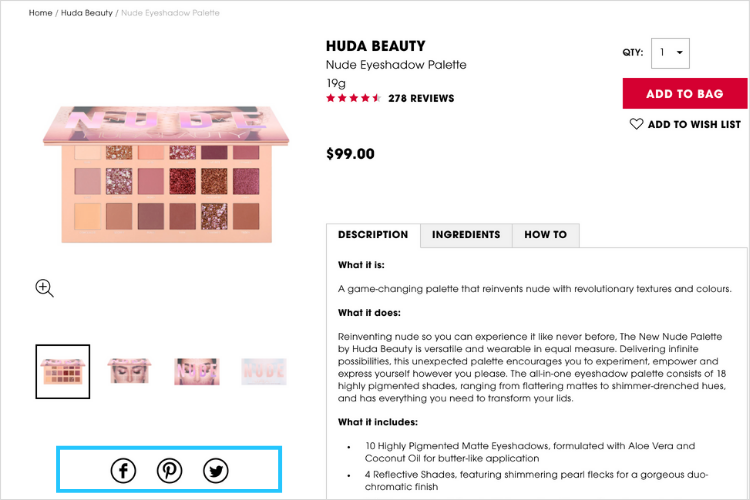

Rich Pins are a great way to add extra detail to your Pins, whilst also encouraging more click-throughs to your website!

Rich Pins work by pulling extra details into Pinterest when a Pin is created from your website.

Currently, there are four types of Rich Pins you can use on Pinterest: “Product”, “Article”, “App”, and “Recipe”.

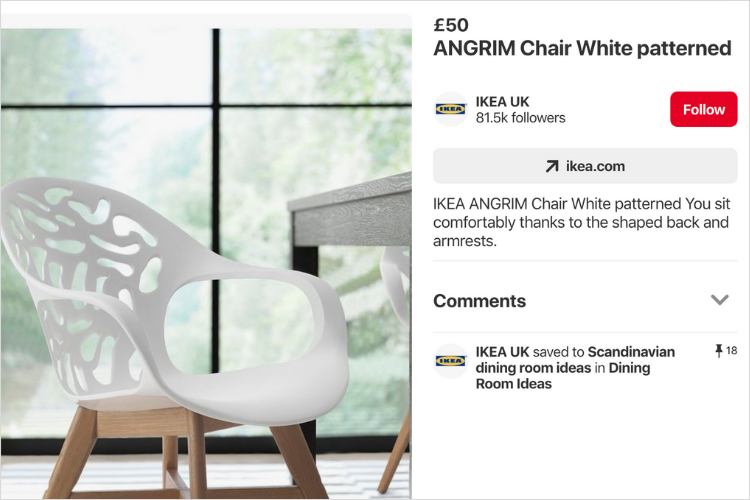

For online retailers, Product Pins make shopping super easy through Pinterest, as they include real-time pricing, availability, and information on where to buy your product.

IKEA is even digitizing their 200-page print catalogs with the help of Pinterest Product Pins!

According to ModernRetail, their new shopping app will display Product Pins in personalized user boards — populated based on the results of a questionnaire about item and style preferences.

Recipe and Article Pins are perfect for publishers and bloggers looking to attract new site visitors from Pinterest. See how Whole Foods Market uses Recipe Rich Pins to provide extra value and encourage more click-throughs.

If you want to add Rich Pins to your Pinterest for Business profile, you can follow the steps on Pinterest here. Creating Rich Pins require a bit of technical work, so you might need to contact your website developers or your website hosting platform to get it all up and running.

But the technical effort really pays off! Rich Pins are the easiest way to share extra, valuable information with your audience on Pinterest — which can encourage more clicks back to your site!

Find out more about the different types of Rich Pins and how you can use them in The Beginner’s Guide to Using Pinterest for Business.

How to Create Pins Tip #4: Stick to the Recommended Ratios

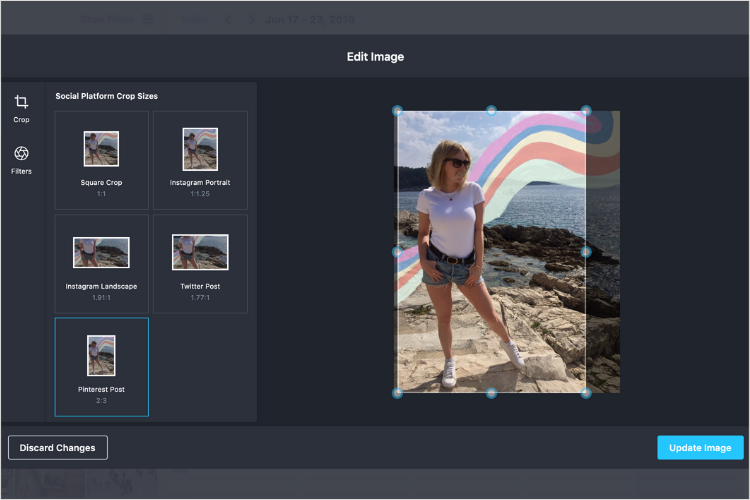

Although Pinterest does support Pins in a wide range of dimensions, the recommended Pin ratio is 2:3 (1000 x 1500 pixels).

According to Pinterest: “Other ratios may cause your Pin to get truncated, or may negatively impact performance.”

And considering that 80% of people currently use Pinterest on mobile, it’s definitely a good idea to optimize your Pins for views on-the-go.

Tip: With Later, you can easily optimize your images for Pinterest as you plan and schedule your content!

How to Create Pins Tip #5: Add Attention-Grabbing Text

Although Pin titles are important for SEO on Pinterest, they’re quite difficult to read in the Pinterest app.

So if you want to grab the attention of browsers — and encourage more click-throughs to your content — one of the best ways to do this is by adding engaging text overlays to your Pins.

Check out how Mashable and Penguin Random House both follow this same technique to grab attention and increase site traffic from Pinterest.

Your text overlays should be easy to read and appeal to your target audience. They should hint at the value your content offers, without being clickbaity or misleading.

Thankfully, there are a ton of design apps available to help you easily create standout Pins.

For example, with design app Over, you can select any background image, crop it to Pinterest’s optimal dimensions, and add your chosen text.

You can choose from a huge range of fonts for free, or even import your own branded fonts with an Over Pro subscription. Check out this blog post to find out how to do this easy hack!

How to Create Pins Tip #6: Create Seasonally Relevant Pins

Pinterest is a go-to destination for inspiration, so tapping into seasonal events — such as Easter, Halloween, Christmas, and New Years — is a guaranteed way to gain more traffic for your content.

That being said, it’s important to make sure your Pins are both seasonal and relevant to your business.

For example, if you run a dental practice, you may want to share: “10 Festive Treats That Are Kind to Teeth”, rather than: “10 Ways to Make Homemade Christmas Tree Decorations”.

Grocery store Tesco shared “spooktacular” tips on how to transform their cakes for Halloween last year. This works as it features their products and ties into a seasonal theme.

According to Pinterest, people use the platform to plan for seasonal events long before they turn to other platforms — so aim to create seasonally relevant Pins at least 30 days in advance!

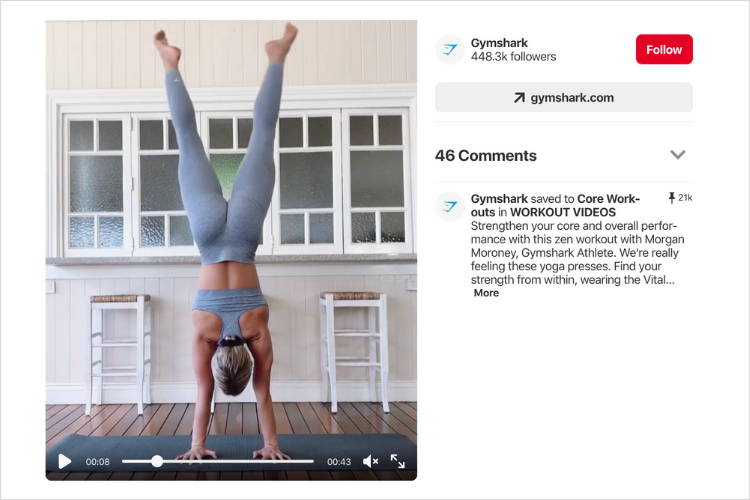

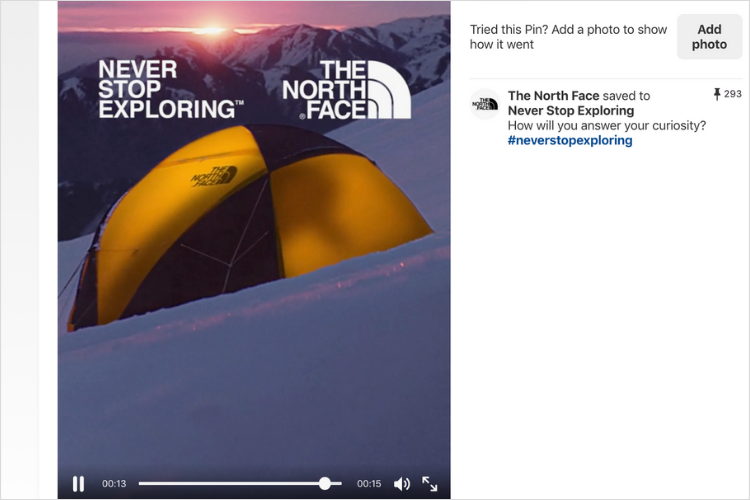

How to Create Pins Tip #7: Create Video Pins for Pinterest

Video is one of the best tools in a marketers toolbox for growing engagement — and now you can harness that with your Pinterest marketing strategy.

If you’re ready to skyrocket your growth on Pinterest, it’s time to start publishing Video Pins to Pinterest.

As Pinners are mindlessly scrolling boards or their Smart Feed on desktop, Video Pins automatically start playing as they’re halfway down the screen. Naturally, the movement of the Video Pin will catch the pinners’ attention and make them more interested in clicking in.

The Benefits of Video Pins

Whether it’s TikTok, Instagram, Facebook, or YouTube, people love to watch videos. They’re engaging, eye-catching, and the perfect format to showcase products or services in action.

And, video on Pinterest is no different. Video Pins allow brands and businesses to share so much more on the platform. From authentic storytelling and product demos to tutorials and recipes — the options are endless!

With the added value, it’s more likely that a Pinner will save the Pin to one of their boards — telling Pinterest that they like your content.

Pinterest uses this information as a positive indicator and will boost your Pin in future search results.

Another added benefit? You can use Video Pins to drive users outside of Pinterest. Think about directing them to your YouTube channel, website, or product pages

And, once a user has engaged with your Video Pin, they are more likely to click through the Pin’s link — which is great for cross-promotion and sales.

3 Tips for Creating Pinterest Video Pins

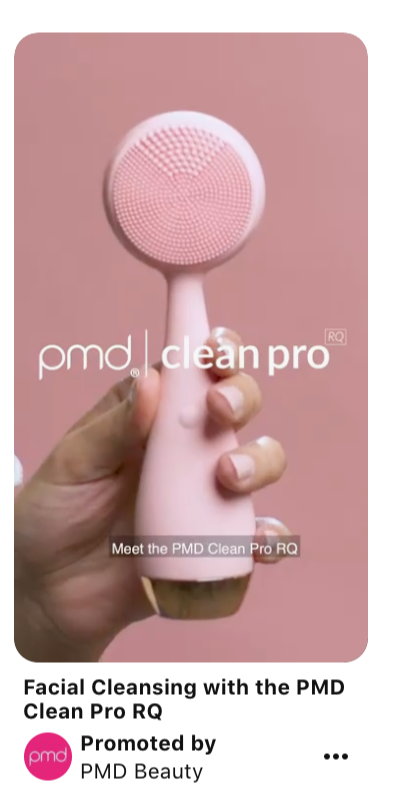

Tip #1: Add Text Overlay

One effective way to grab and keep attention is by adding text overlay to your Video Pins.

Users typically scroll Pinterest with their sound off, so adding text-on-video is an incredible tool to help your users stay engaged. Check out how PMD Beauty has added subtitles to their videos:

Plus, you don’t have to be an editing wiz to add scroll-stopping text to your Video Pins. There are tons of apps you can use to add text, edit, and create the videos themselves.

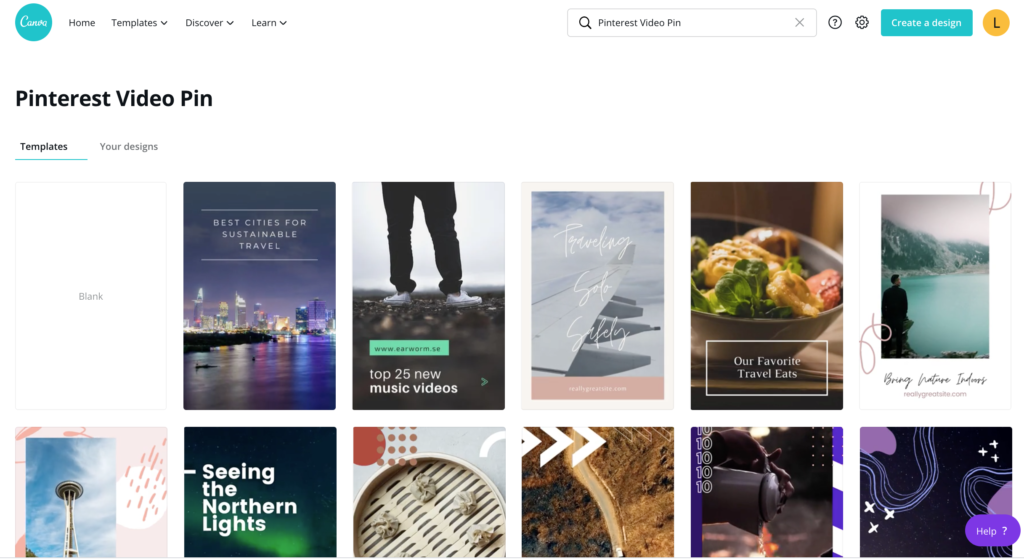

Canva is a great resource, especially since they’re an official creative Pinterest Partner. They offer hundreds of easy and quick to use Pinterest video templates to choose from. They even have a built-in video maker and editor with easy drag-and-drop tools.

Tip #2: Grab Attention Right Away

Across all platforms, there is one golden rule: grab the viewer’s attention as soon as possible.

With only a few seconds at play, you have to include something that will catch attention before they keep scrolling.

Think about kicking off with your most interesting products, lots of movement and color, or use intriguing text within the first few seconds — make that intro count!

TIP: Keep your Video Pins short and captivating. Pinterest recommends short videos between 6-15 seconds long.

Tip #3: Set Up for SEO Success

Video Pins should include clear titles, descriptions, and hashtags to help with discoverability in search results.

To help with discoverability, Pinterest has a simple (yet effective!) auto-suggest tagging feature. Just type your keywords and pick from the auto-suggested relevant tags Pinterest gives you.

When you categorize your Video Pins, it makes it easier for users to find your content when searching — this means more views!

How to Schedule Video Pins with Later

As an official Pinterest Marketing Partner, Later provides exclusive features and solutions to help you get the most out of Pinterest.

In fact, Later is one of the only platforms that can schedule videos to Pinterest, which allows our customers to connect with Pinterest’s growing community in more ways.

Scheduling Video Pins to Pinterest has never been easier — select your video from the media library and drag and drop it onto your content calendar to schedule.

When you’re ready to format, you’ll see that Later’s editing tools allow you to choose from four different sizing options:

Freeform: Choose a custom crop size

Square: 1:1 aspect ratio

Portrait: 4.5 aspect ratio

Landscape: 16.9 aspect ratio

You can also trim the beginning or end of your video. There’s no limit to the amount you can trim, but remember videos need to be at least 4 seconds long on Pinterest.

Here you can add a caption, a link, and a description for your Pin. Once you’ve added all the important details, you’re ready to hit save and schedule with Later!

Once you save your post, Later will submit your Pin for approval (all videos must be approved by Pinterest). When your Pin has been approved, you’ll see an “Approved” tag right there in the calendar post.

Pinterest video scheduling is available on all paid plans, starting at just $9/month. Upgrade now!

How to Curate Boards That Support Your Pinterest Marketing Strategy & Brand Values

Creating all of your Pins from scratch would be a huge undertaking for any business.

Thankfully, you can also curate existing Pins into your Pinterest Boards, providing a fresh stream of content to raise your brand awareness.

What are Pinterest Boards?

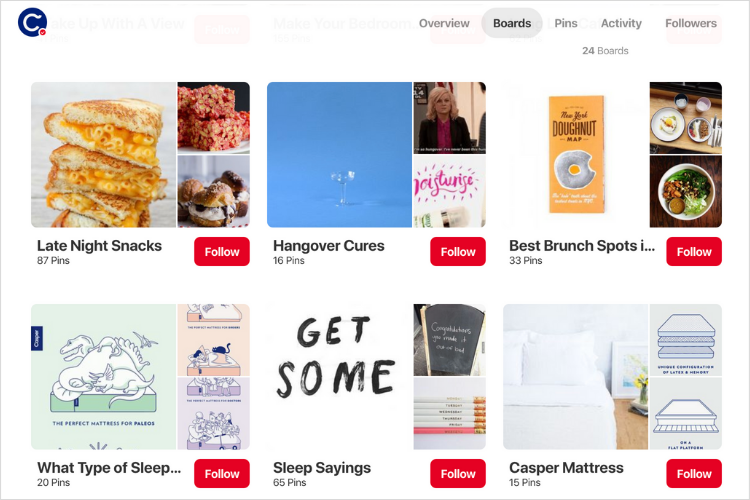

Pinterest Boards are effectively just folders for your Pins.

By curating and saving your Pins to boards, you’re creating a valuable catalog of content for your followers to discover.

Plus, curating Pins to your own boards is what the Pinterest community is all about — it helps spread Pins to a wider audience and gives much-deserved kudos to other Pinterest creators!

But before you save a Pin to one of your boards, it’s worth considering a few key factors:

#1: Does it Support Your Brand Message?

First and foremost, it’s always worth considering how a Pin connects with your brand before you save it to your account.

It could be a seriously funny or interesting Pin, but it has nothing to do with your brand, it won’t provide any value for you in the long run. In fact, it might only serve to confuse visitors to your account.

Take note of how mattress brand Casper curates Pins that fit with their sleep-loving POV, such as “Late Night Snacks”, and “Sleep Sayings”.

#2: Is The Original Pin Creator Aligned With Your Brand?

The Pins you save to your Pinterest account will instantly be associated with your brand.

With this in mind, if the original Pin was made by an organization or individual that you don’t want to publicly support — it’s worth thinking twice before you click save.

On the flip side, this is also a great opportunity to associate your brand with industry thought leaders and pioneers!

#3: Does it Add Value For Your Audience?

Consider the value of a Pin for your audience — will they engage with it? Does it reflect their beliefs or values? Does it provide a service to them?

Ultimately, every Pin you share should be centered around your target audience. For example, Well + Good shares a whole range of content — from recipes to workouts — that is likely to be popular with their target audience.

By sharing a mix of original and existing content on Pinterest, you can support your brand identity and keep up your activity rate — without draining too much design time.

So now you know how to create and curate great Pins, it’s time to make sure they get plenty of views!

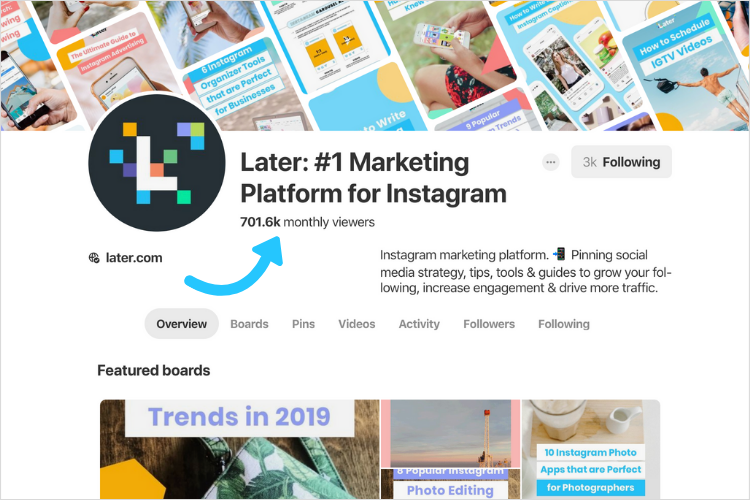

6 Pinterest Marketing Tips to Increase Traffic

Followers are always great to have, but attracting a high volume of traffic on Pinterest is even more important — especially when your goal is to turn browsers into lifelong customers.

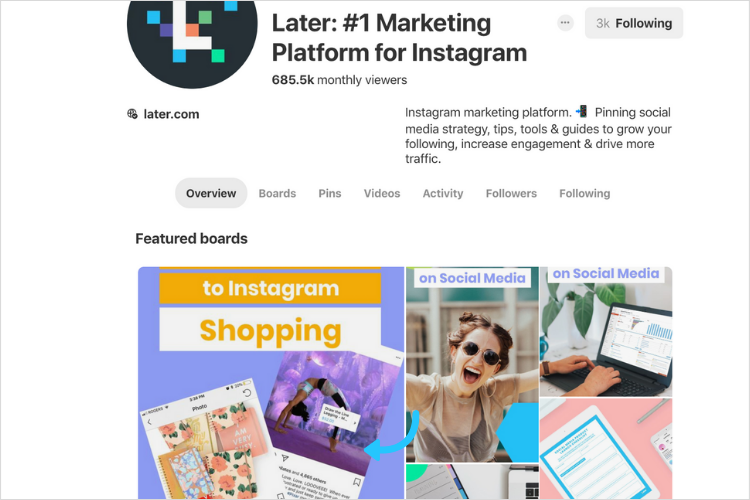

In fact, the number of monthly viewers is probably the most important stat to pay attention to on your profile page.

So don’t worry too much about your follower count on Pinterest. Start optimizing your Pins for more traffic instead!

How to Increase Traffic on Pinterest #1: Optimize For Search

As we covered earlier, Pinterest is a visual search engine. So you can have the most beautiful, aesthetically pleasing Pins out there, but they won’t be seen unless they’re optimized for search.

And when you take into account that 98% of users have tried something new that they discovered on Pinterest, it’s worth optimizing your account so your Pins are as easy to discover as possible.

So how can you do this for your business?

The trick is to add relevant keywords on Pinterest that are specific to your business, and aligned with what your target audience is searching for. Think of it like SEO for a blog post.

Pinterest SEO Tip #1: Add Keywords to Your Pin Title

There are multiple places you can include SEO keywords, but one of the most important places is your Pin title. Your keywords here should cover as many bases as possible — as this will help your Pins get into your audience’s search results.

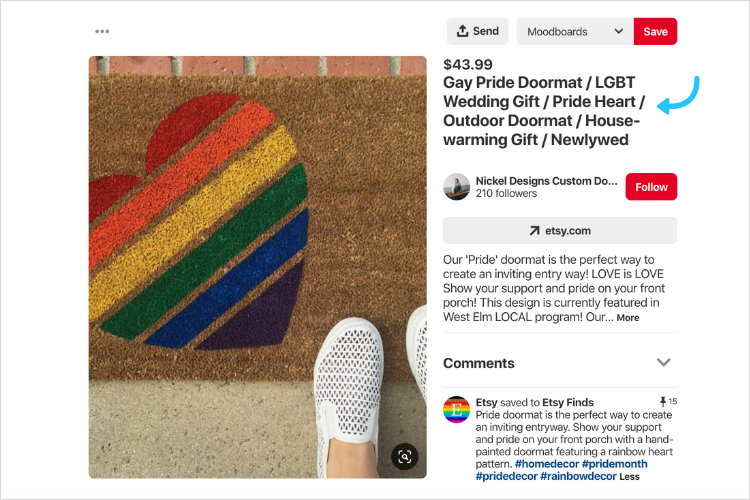

Take note of how Etsy uses multiple search keywords in their Pin titles, covering both what the product is and who it’s for.

Pinterest SEO Tip #2: Add Keywords and Hashtags to Your Pin Descriptions

In addition to having optimized keywords in your Pin titles, you should also include them in your Pin descriptions — alongside relevant search hashtags.

Although there is no definitive rule book, high-traffic Pins tend to include between 5-10 keywords and 3-5 hashtags.

The best way to add keywords to your Pin descriptions is in sentence format, so that your Pin descriptions are also easy to read.

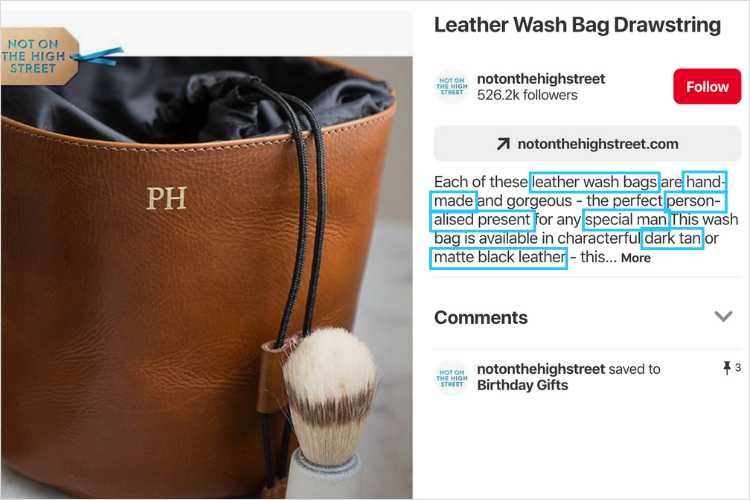

See how Not On The High Street captures multiple keywords in their Pin descriptions, whilst also providing an informative description for browsers.

For hashtags, keep in mind that Pinterest hashtags are purely for discovery through search trends. So the humorous hashtags you’re familiar with on Instagram — such as #sorrynotsorry — aren’t going to help on Pinterest.

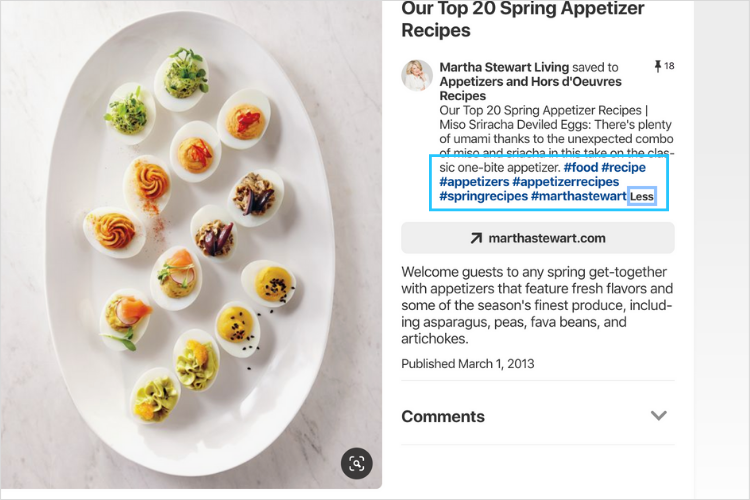

See how Martha Stewart Living uses hashtags to effectively categorize Pins by popular search topics.

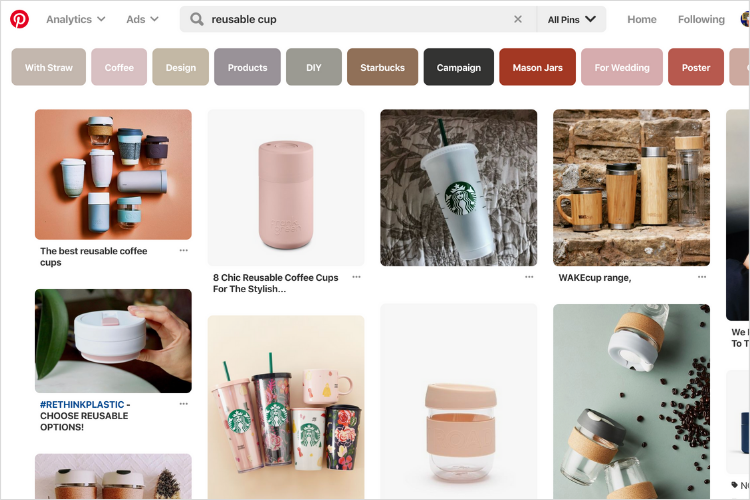

Pinterest SEO Tip #3: Use Pinterest’s Keyword Research Tool

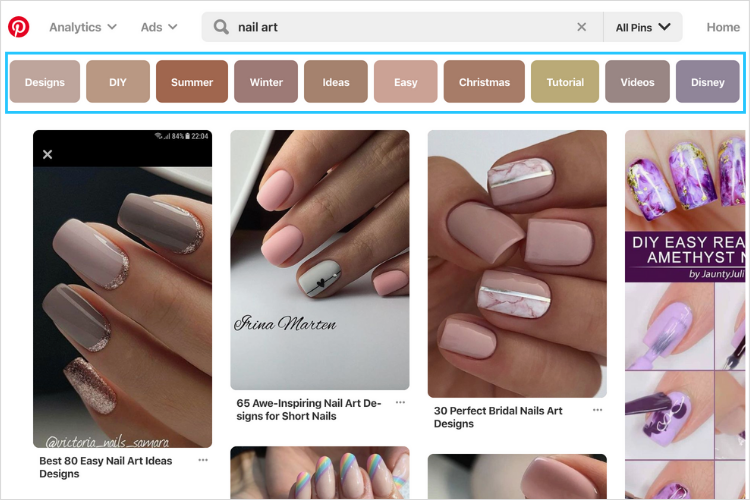

If you’re unsure on what keywords and hashtags you should be adding to your Pins, you can find inspiration by using Pinterest’s built-in keyword research tool.

By searching for a generic term — such as “nail art” — in the Pinterest search bar, you will see a selection of keywords provided by Pinterest to make your search more specific.

These recommended keywords are ordered by search popularity, so you can take this into account as you plan the keywords and hashtags for your Pins.

For example, if you don’t have a huge number of followers, it might be worth opting for less popular keywords. The chances are, you’ll have less competition for those keywords, which means you’ll rank higher in the search results.

Although finding and adding keywords may seem like extra effort, this is one of the best ways to secure more traffic for your Pins.

With the right SEO strategy on Pinterest, you’ll be able to grow your audience efficiently and effectively — without spending hours promoting your content.

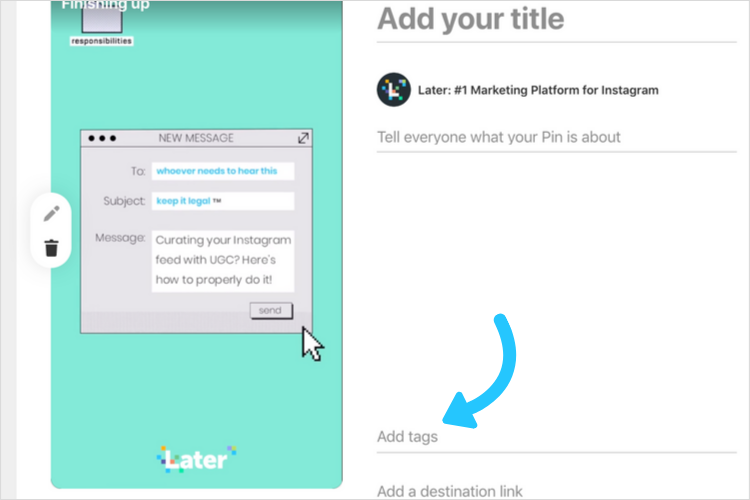

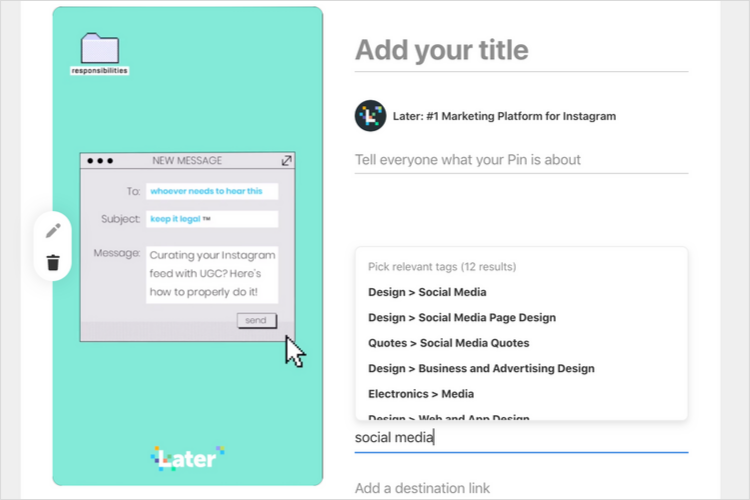

Pinterest SEO Tip #4: Add Tags to Pinterest Videos

Pinterest has recently added a new auto-suggest tagging feature to help improve the discoverability of your video Pins!

Simply type in keywords and pick from the relevant tags that are auto-suggested:

Categorizing video Pins with tags makes them easier to find — which means more views for your content!

How to Increase Traffic on Pinterest #2: Invite Brands and Influencers to Collaborate on Your Boards

Inviting brands or influencers to collaborate on your boards is a great way to increase your exposure on Pinterest.

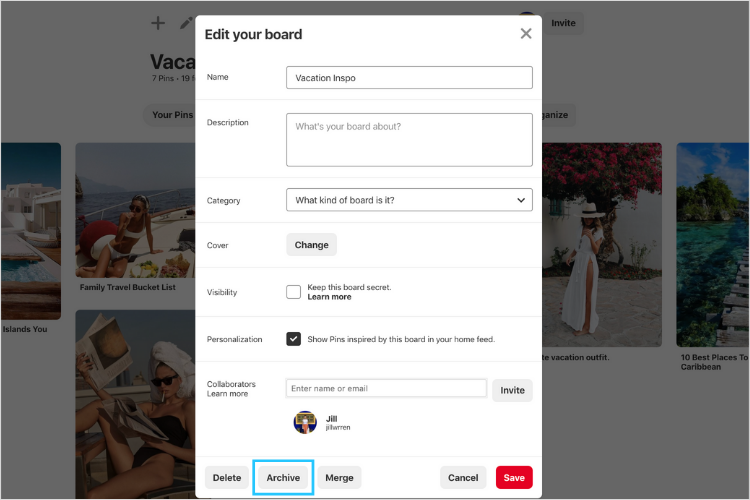

To do this, open one of your boards and click the pencil icon to “Edit your board”. You can then search and add as many collaborators as you want — even when your board is “secret”, i.e. hidden from all other users.

Inviting collaborators to your boards is a handy way to create a stronger sense of community on Pinterest — but it’s important to adopt a strategy that works for your business.

For example, you may want to reach out to potential collaborators before you send them an invite, so that you can explain your vision, goals, and any specific Pin requirements.

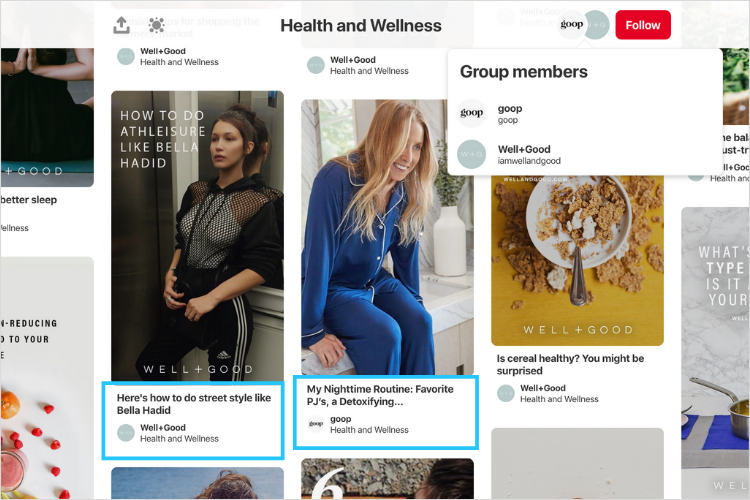

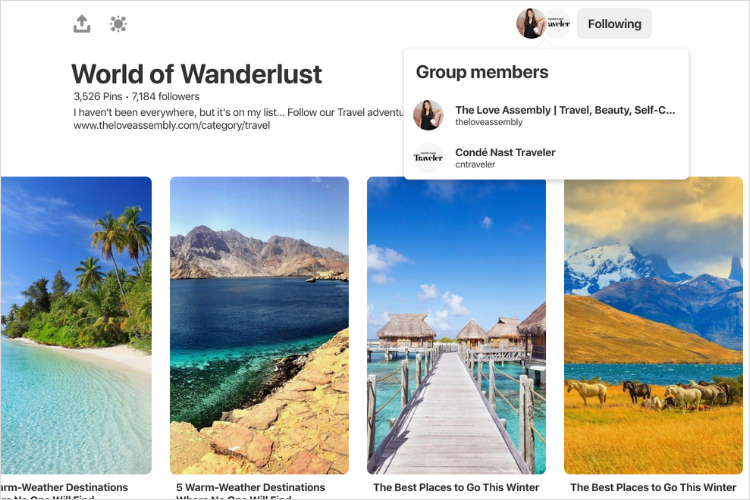

Check out how Well+Good and goop both collaborate on the same “Health and Wellness” board — capitalizing on their shared brand values and similar demographics to cross-promote each other.

While Condé Nast Traveler regularly collaborates on travel influencer The Love Assembly’s “World of Wanderlust” board.

Inviting users to collaborate is a great way to build strategic partnerships, and could result in them inviting you to collaborate on their boards too!

How to Increase Traffic on Pinterest #3: Pin Regularly

Thanks to the Pinterest algorithm, more recent Pins are more likely to be surfaced above older ones in a search result.

With this in mind, it’s a good idea to regularly publish new Pins to increase your traffic — even when you feel as though your boards are aesthetically “complete”.

Not only this, but regularly pinning will show new visitors to your profile that you’re still active on Pinterest — an indicator that you could be worthwhile following for future content.

That being said, there can be too much of a good thing — as Pinterest will penalize activity that appears too “spammy”.

There are no set guidelines on Pin volume, but it’s best to limit your activity to 30 Pins per day to stay on the safe side.

Save time by planning and scheduling all your Pins in advance with Later — for free!

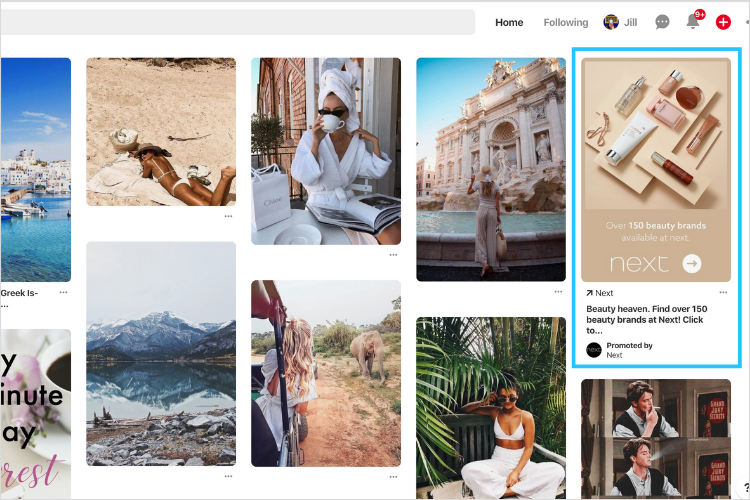

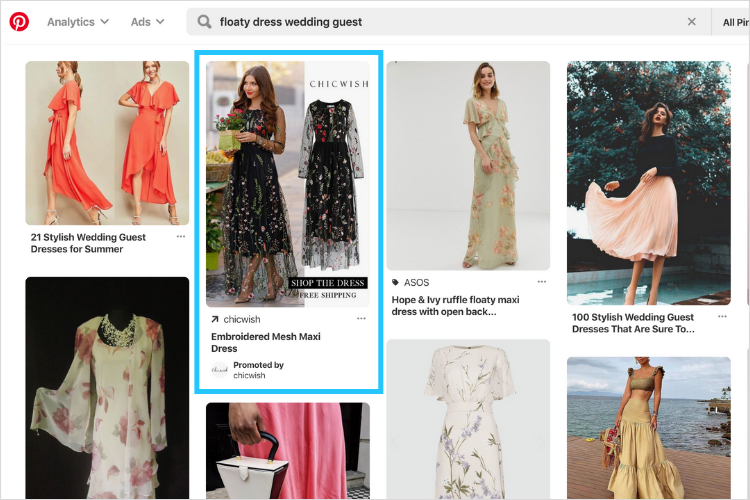

How to Increase Traffic on Pinterest #4: Create Ads on Pinterest With Promoted Pins

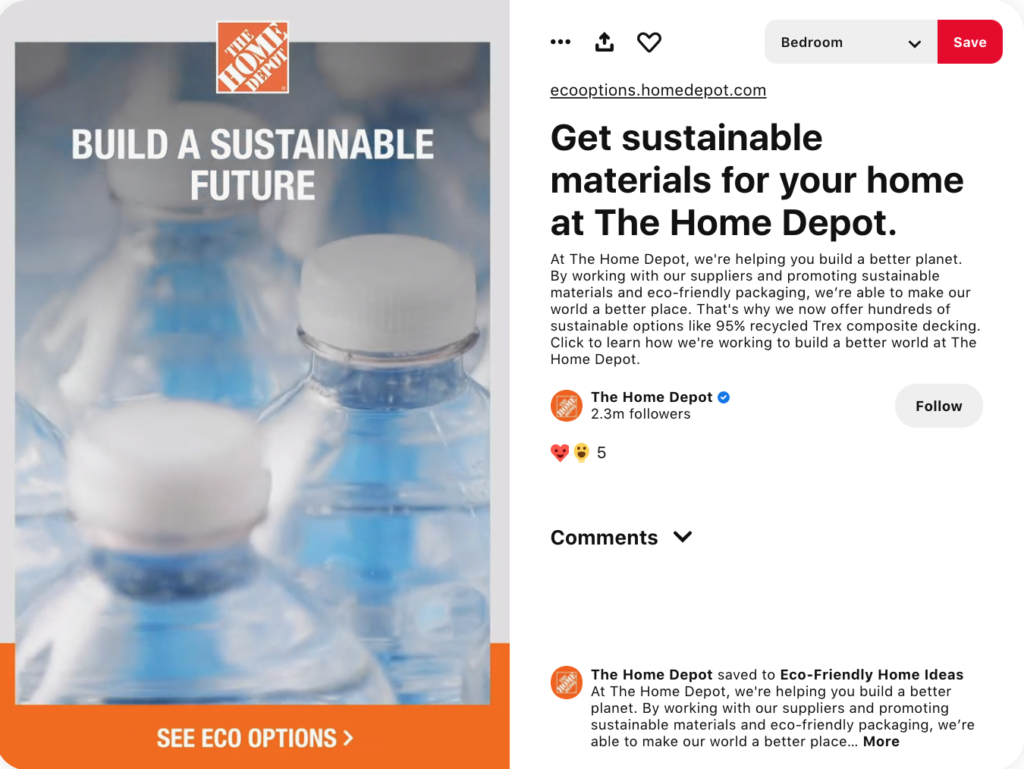

Once you’ve switched to a Pinterest Business account, you can start creating ads in the form of “Promoted Pins”.

Promoted Pins are the easiest way to get your product in front of the right audience — as your Pins will be surfaced in more search results.

To capitalize on this extra exposure, it’s a good idea to use Pins that attract attention and encourage clicks. Consider using eye-catching designs, clearly visible messaging or branding, and intriguing Pin titles.

The amount you spend on a Promoted Pin will depend on the budget and spending limits you set for your campaigns, which you can control through your Pinterest Ad Manager.

According to Pinterest, 83% of weekly Pinners made a purchase based on Pins they saw from brands.

So with this in mind, boosting the visibility of your Pins could be a great way to increase traffic and reach new customers!

How to Increase Traffic on Pinterest #5: Create Relevant, Highly Shareable Pins

Creating Pins that resonate with your audience is one of the quickest ways to encourage saves on Pinterest.

However, it’s definitely worth aligning your shareable Pins with your brand DNA. A fun but irrelevant Pin might serve for a quick return, but it won’t help your brand perception in the long run.

Take note of how fitness brand Sweaty Betty create quotation Pins that are super relevant to their audience, tapping into their passion for fitness, wellbeing, and self-improvement.

By striking a balance between relevant and share-worthy, you will attract the right audience for your brand and continually grow your Pinterest community.

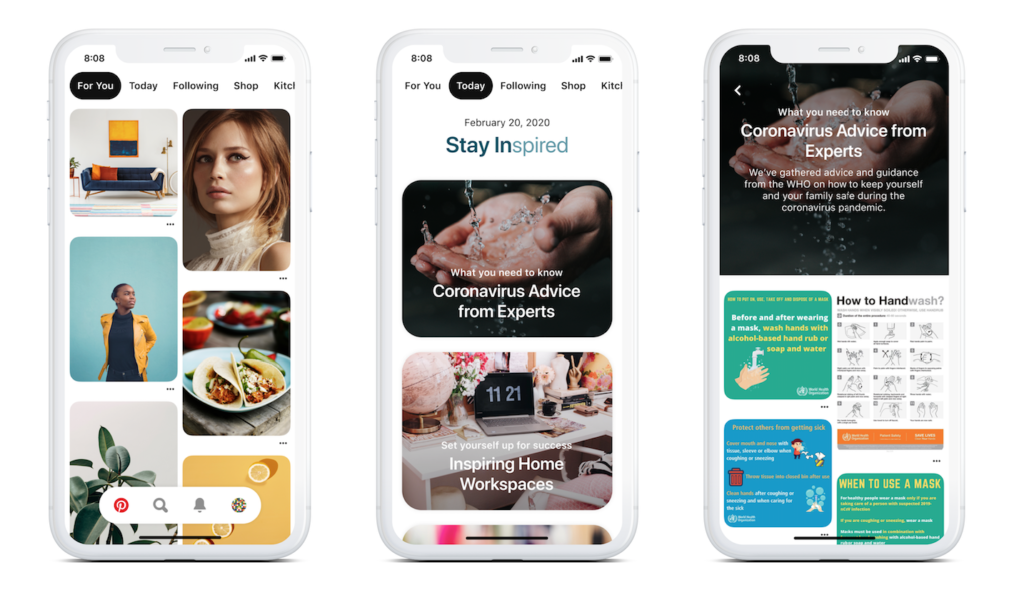

Creating highly shareable Pins is also a great way to be featured under the Today tab — a new tab on the home feed designed to inspire Pinners with daily curated topics and trending Pins.

Like Pinterest’s “For You” tab, the Today tab is a collection of curated content. The main difference with the Today tab is that instead of personalized results, it shows you what’s going on in the world — curated by the Pinterest team.

It’s a mixture of curated and trending searches — to keep you up to date on what’s trending on Pinterest on that specific day!

For example, if “work from home” is a trending search on Pinterest, you may see Pins relating to “home workspaces” under the Today tab, rather than Pins explaining how to cook quinoa.

With relevant, highly shareable Pins, your Pins could be featured under the Today tab for thousands of eyes to see!

The Today tab is currently available for Pinners living in the United States and the United Kingdom, with more countries to follow.

Pinterest Marketing Strategy: How to Cross-promote Your Site and Pinterest Account

By optimizing your Pinterest strategy, you can seamlessly drive users from your Pins to your site — where they can find and buy all of your products and services.

And with the right strategy on your site, you can encourage users to share your content straight to Pinterest — increasing your brand visibility at no extra cost to you!

Cross-promotion Tip #1: Claim Your Site on Pinterest

Claiming your site on Pinterest brings a multitude of benefits. Not only does it validate your authenticity on Pinterest, but it also pulls in all of the Pinterest “Activity” that is occurring on your site.

This is a quick and easy way to cross-promote your site, while also providing a unique insight into what motivates your site visitors to start Pinning!

Cross-promotion Tip #2: Regularly Link to Your Site From Your Pins

As you plan your Pinterest strategy, it’s worth taking into consideration how often you’re linking back to your main business site.

If you find you’re Pinning content from — or linking to — third-party sites more than your own, then you might want to rethink your strategy.

Regularly linking back to your site is an effective way to drive more click-throughs, which could lead to more customers for your business.

Cross-promotion Tip #3: Create Pin-Ready Images

Did you know that the “Pinterest Save Button” Chrome extension has over 10 million users?

It’s therefore worth making sure your share images are optimized for people to save to Pinterest with just one click.

At Later, we create Pinterest share images for our blog posts in the ideal 2:3 ratio for Pinterest, with clearly visible text overlays.

Cross-promotion Tip #4: Add Pinterest Share Buttons to Your Site

One final way to cross-promote your site is by including social share links on blog posts and product pages.

Sephora does this on every product page on their site.

Including share icons across your site is an effective way to encourage more social shares — which is one of the easiest and most effective ways to boost your brand awareness!

How to Use Analytics to Tailor Your Pinterest Marketing Strategy

With a Pinterest Business account, you have access to all in-app analytics associated with your Pinterest profile.

Taking a look at your Pinterest Analytics is a great way to learn what’s working for your audience — and can help inform your Pinterest marketing strategy.

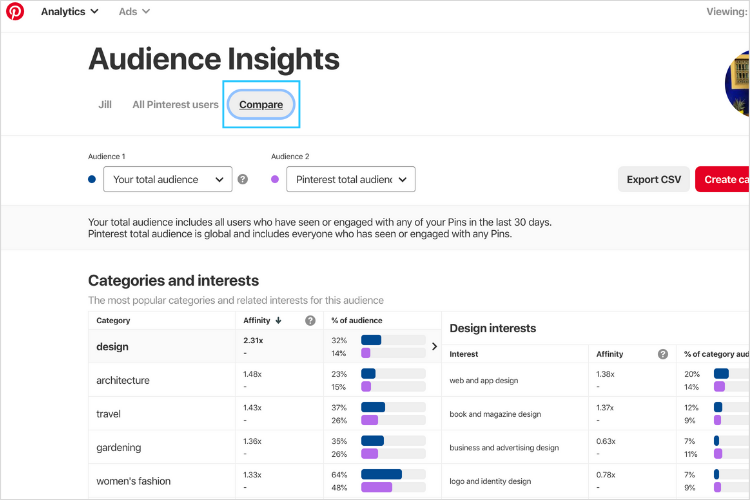

#1: Understand Your Pinterest Audience

Your audience on Pinterest can be hugely different to your audience on other platforms — and they typically have more spending power too!

Taking this into account, it’s a good idea to use Pinterest Analytics “Audience Insights” to understand who you’re connecting with, and what they’re interested in.

You can even compare your Pinterest audience to Pinterest’s total audience, which gives valuable context on how your audience differs to the overall Pinterest audience.

BONUS TIP: You can track and measure your Pinterest growth over the last 3 months with Later. Just check out your Pinterest Analytics from your Later app!

You can also take a deep dive into all of your posts scheduled through Later, and see which posts have performed best.

With a deeper understanding of your Pinterest analytics, you can tailor your content strategy with your audience in mind.

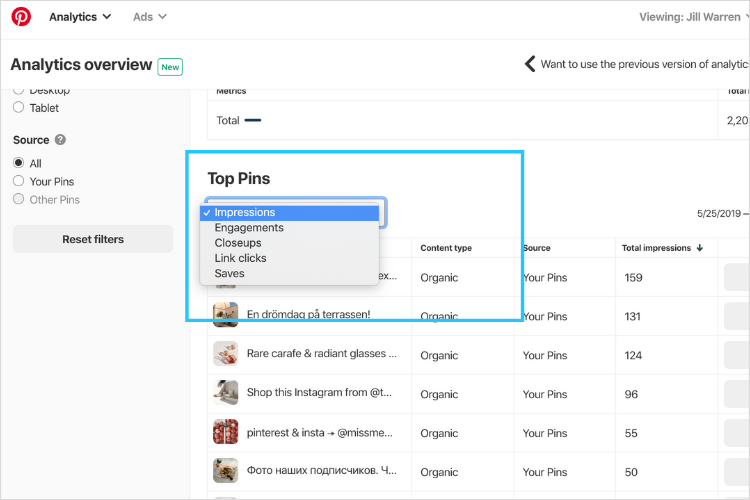

#2: Revamp and Repost Top Performing Pins

As we covered earlier, older Pins — even top-performing ones — can get buried in a user’s search results.

The new “Analytics Overview” page in Pinterest Analytics allows you to filter your Pin performance by “Date range”, “Content type”, “Devices”, and “Source”.

By monitoring your “Top Pins” from historical date ranges, you can identify potential Pins to revamp and repost on your account.

You can filter your “Top Pins” by “Impressions”, “Engagements”, “Closeups”, “Link clicks”, and “Saves”. If your main goal is to drive traffic back to your site, it could be worth honing in on your “Top Pins” by “Link clicks”.

By re-sharing these Pins, you’ll give them a fresh lease of life — and benefit from their conversion power all over again!

#3: Add “Featured Boards” to Your Pinterest Overview

As with any site, it’s important to keep your Pinterest Overview page optimized with relevant, captivating content.

With a Pinterest Business account, you can select up to 5 “Featured Boards” that will display on rotation at the top of your profile.

Choose boards that are a good fit for your audience based on your Pinterest Analytics. If you’re not sure which ones are a good match, opt for boards which contain a high volume of “Top Pins”.

To add Featured boards to your Pinterest Overview page, follow the steps here.

#4: Archive Poorly Performing Boards

Similarly, it’s a good idea to regularly prune boards that are no longer popular with your audience on Pinterest.

Keeping your boards laser-focused and hyper-relevant will keep your Pinterest super strong — and will decrease the likelihood of someone clicking away from your profile without following first.

So if you don’t have any “Top Pins” in a board, it might be worth considering if it needs to be archived.

To do this, open one of your boards and click the pencil icon to “Edit your board”. You can then select “Archive”.

Keeping on top of your analytics is the best way to understand what’s working for your brand on Pinterest.

Congratulations! You now have all the tips and tricks you need to level-up your Pinterest marketing strategy!

With a successful Pinterest marketing strategy, you can build an audience that loves your content, engages with your brand, and buys your products.

So what are you waiting for? Get Pinning today!

Plan, schedule, and analyze your Pins with Later!

Sign up today and join the 2 million businesses already using Later to manage their social accounts.