Whether you’re a budding brand or an established enterprise, tapping into TikTok influencer marketing is a no-brainer.

Case in point: TikTok is on track to become the largest social platform in total daily minutes by 2025 — making it the perfect space to create targeted campaigns that generate leads.

So, we’re sharing what TikTok influencer marketing is, how to make it a part of your strategy, and all the inspiration you need to get started.

Table of Contents

What Is TikTok Influencer Marketing?

TikTok influencer marketing is a type of social media marketing where brands partner with popular TikTok creators to promote their products or services.

Where traditional ads can miss their mark with younger audiences, TikTok creators have the selling power to turn your brand into a trusted online name.

FYI: Later's influencer marketing solutions are trusted by enterprise businesses to source and manage lasting relationships with TikTok influencers. Learn more.

3 Reasons Why TikTok Influencer Marketing Works

Whether it’s to tap into a new audience or promote your latest product, here are the top three benefits of investing in TikTok influencer marketing:

#1: Get Direct Access to Your Target Audience

Especially if you’re new to TikTok, handing the reins to an influencer in your niche is the definition of going directly to the source.

And when over half of TikTok users are Gen Z who crave “authentic” recommendations — collaborating with the creators they already love and trust is key.

#2: Enhance Social Proof

It’s simple: Building a rapport with an influencer and their engaged audience is the best way to spread the noble word about your brand.�

The cherry on top? A long-term partnership for maximized results.

#3: Increase Sales

According to data from Digital Marketing Institute, 49% of consumers depend on influencer recommendations.

If a trusted influencer in your niche recommends your product, it’s fair to assume you’re the real deal.

TIP: Bookmark this blog for a deeper dive into the power of TikTok influencer marketing: 7 of the Best TikTok Brand Collaborations — And Why They Work

6 Steps to a Successful TikTok Influencer Marketing Campaign

Ready to kick off your first TikTok influencer marketing campaign? We’ve got you covered, in six simple steps:

Set Clear Campaign Goals

Find & Verify Potential TikTok Influencer Partners

Reach Out to TikTok Influencers

Set a Statement of Work

Kick Off Content Creation

Measure Results

#1: Set Clear Campaign Goals

Before you launch your first TikTok influencer marketing campaign, it’s essential to define your SMART goals and metrics.

Do you want to increase traffic to your website? Raise brand awareness? How much are you willing to spend to accomplish these goals?

This will guide the type of TikTok influencers you work with, what deliverables to ask for, and help drive your strategy forward.

#2: Find & Verify Potential TikTok Influencer Partners

There are five tiers of influencers you can work with based on their TikTok follower count:

Nano: 0K – 10K

Micro: 10K-100K

Mid: 100K – 500K

Macro: 500K – 1M

Mega Macro: 1M+

However, the best TikTok influencer marketing partners are those who align with your target audience and brand.

You should ideally work with niche influencers who have high engagement rates, post consistently, and have a distinct personality or voice.

Here are a few ways you can find and verify TikTok influencers for your next campaign:

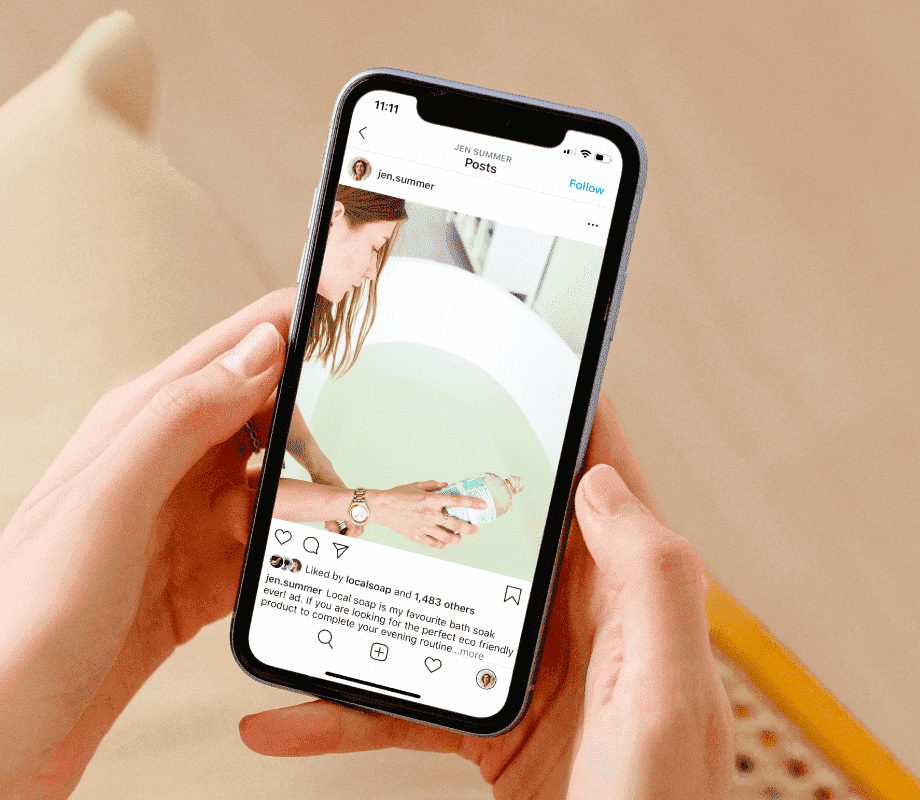

#1: Pay attention to your social media comments and tags

If someone is actually a fan of your brand, it will feel like a natural collaboration when they promote your products to their followers.

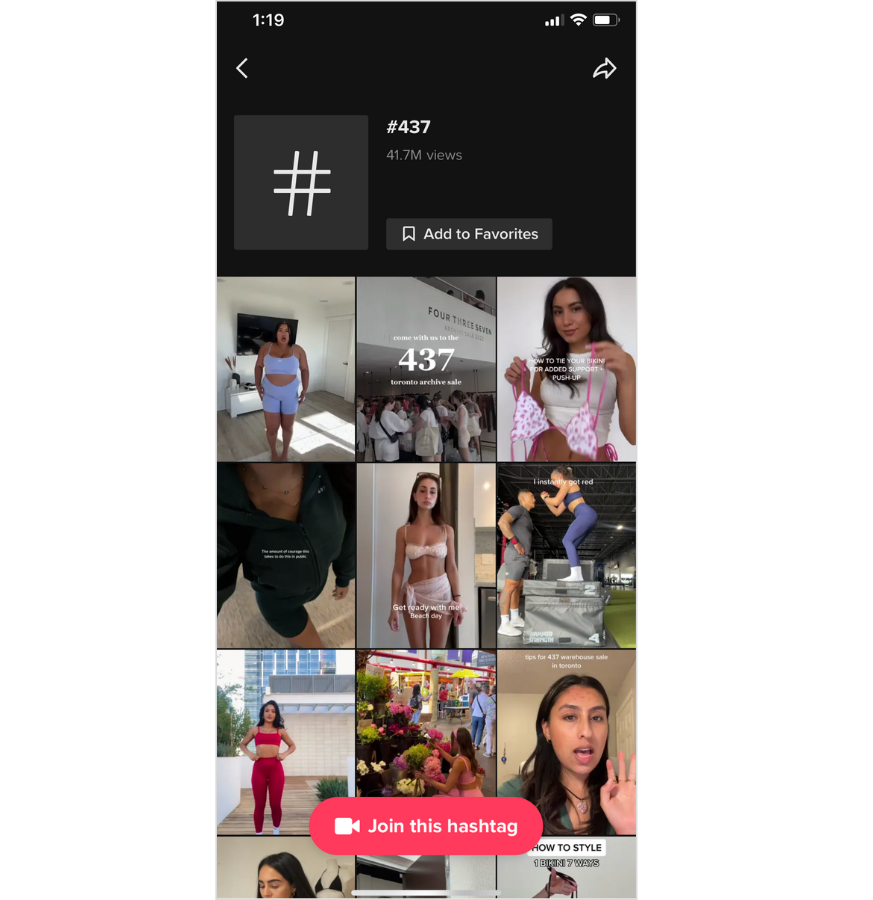

#2: Monitor your branded hashtag

Similar to comments and tags, if a TikTok influencer frequently uses your branded hashtag, they likely have a genuine passion for your business and will be keen to partner on a campaign.

#3: Use an influencer & creator database tool

Finding the right partnership can feel like a full-time job without the right tools — but who said you have to do the heavy lifting?

A third-party tool like Later's influencer marketing platform will do the work for you — from discovering TikTok influencers to maximizing your campaigns.

Intrigued? Get started with Later Influence™ today!

#3: Reach Out to TikTok Influencers

Once you’ve compiled a shortlist of potential influencer partners, it’s time to make the first move.

Your initial message to a creator could make or break a potential partnership, so it’s worth putting in some extra effort.

If in doubt, follow this guide:

Introduce yourself: Be clear with who you are and your role. Talk about why you think they’d be a great fit for the campaign.

Outline your campaign idea: Let them know what you have in mind for the collaboration.

Ask for their media kit: Get insight into their audience demographics, important numbers, and past collaborations.

Detail your budget or ask for their rates: Keep in mind that rates can fluctuate — so be ready to negotiate a fee based on your budget and expected deliverables.

TIP: You can automate influencer discovery and outreach with Later's tools. Book Schedule a call to learn more.

#4: Set a Statement of Work

Congrats, you’ve found a few golden influencers to help you make your mark on TikTok.

To ensure campaigns run smoothly, it’s a good idea to draft up a statement of work for all influencers you work with — no matter how big or small the partnership.

A statement of work or “scope of work” is typically part of a bigger contract that includes things like disclosure guidelines, exclusions, approval processes, and content ownership.

It should include:

Campaign goals

Campaign theme and details

Payment rates, terms, and timeline

Detailed content deliverables

Approval and submission deadlines

#5: Kick Off Content Creation

Once the finer details are settled, it’s time for your influencer partner to get creating.�

Our top tip? Put your trust in the creative's hands to let them work their magic!

Your influencer partnerships on TikTok can (and should) look much different than they do on other social platforms.

Like influencer marketing expert Mady Dewey says, authentic, impactful partnerships are only possible when brands give influencers creative control:

NOTE: As a brand, it’s your responsibility to ensure that you are FTC compliant. Be sure you and your influencer partner are clear on these guidelines before the content goes live.

#6: Measure Results

It’s important to track, monitor, and measure the results of your campaign.

This way, you can see how the content performed and use it to inform future campaigns — whether it’s working with the same TikTok influencers, finding new ones, or setting up different goals.

PRO TIP: Make note of successful campaigns to capitalize on long-term partnerships!

How Much Do TikTok Influencers Charge?

The influencer marketing industry is still fairly new — so there’s unfortunately no universal one-size-fits-all pricing rule.

This means rates fluctuate based on a TikTok influencer’s engagement rate, the length of the agreement, and the type of content you’re looking for.

That said, historically, many digital marketers adhere to a $250-$450 per 10K followers rule, as a starting point.

3 TikTok Influencer Marketing Examples

#1: TRIDENT

This well-known gum brand is no stranger to influencer marketing.

Most recently, they debuted their new packaging of the TRIDENT Pocket Pack on TikTok (and Instagram) through lifestyle creators found on Later’s influencer marketing platform.

The campaign produced a combined 1.7M impressions, 117.4K engagements, and 5.2K clicks across both platforms, proving to be a massive win.

#2: Supergoop

Supergoop takes TikTok influencer marketing almost as seriously as they do SPF.

They’ve invested in long-term partnerships with well-known Mid and Macro creators like Tashi Rodriguez and Abbey Yung — racking up tons of positive engagement over the years.

Proof: Their branded hashtag #supergooppartner sits at a whopping 89M+ views.

#3: MAC Cosmetics

Debated to be one of the most iconic makeup brands, MAC’s success lies in their ability to move with the eras of marketing.

Most recently, the beauty giant partnered with Sabrina Bahsoon aka “Tube Girl” for her first-ever GRWM and runway debut.

The result? 2.7M+ views and engagement by the thousands.

And that’s that — your brand’s guide to TikTok influencer marketing.

With these tips and examples, you’re bound to create (lasting) partnerships that steer the right audience in your brand’s direction.

Ready to create game-changing TikTok influencer partnerships for your brand with Later Influence? Schedule a call to get started, today!