Micro influencer marketing is great for businesses who don’t have the budget to work with Macro influencers, and want to reach a more niche audience.

But who are Micro influencers, how much do they charge, and why should Micro influencer marketing be part of your social media strategy?

We’re breaking it all down, below.

Table of Contents

What Is a Micro Influencer?

A Micro influencer is a creator who has between 10K and 100K followers on a given social platform.

And while their audience may be smaller than Macro influencers, their engagement sure is mighty.

Why? Because Micro influencers often come across as approachable, relatable, and trustworthy.

This makes the products they recommend feel like they're coming from a friend — not a celebrity endorsement.

Connection is the name of the game when it comes to Micro influencers. And thanks to their authenticity, they tend to receive a steady stream of comments, likes, and clicks.

FYI: Later's influencer marketing solutions are trusted by enterprise businesses to discover Micro influencers, manage campaigns, and more. Schedule a call to learn more.

How Much Do Micro Influencers Make?

Since the influencer marketing industry is still fairly new, there’s unfortunately no universal one-size-fits-all pricing rule.

This means rates fluctuate based on the Micro influencer’s engagement rate, the length of the agreement, and the type of content you’re looking for.

That said, historically, many digital marketers adhere to a $250-$450 per 10K followers rule, as a starting point.

The takeaway? While Micro influencers aren’t pseudo-celebrities like those with larger followings, they should still be fairly compensated for their work.

Consider using the $250-$450 per 10K followers rule as a baseline, consider other factors like the number of deliverables, and build a price tag from there.

What Are The Benefits of Working with a Micro Influencer?

With a projected value of $24.1B by 2025, influencer marketing remains a top marketing strategy for brands.

But if that isn’t enough to tickle your fancy, here are four reasons why you should invest in Micro influencers for your next social media marketing campaign:

Benefit #1: Micro Influencers Are Typically More Cost Effective

For many small businesses, your budget may be too small to work with influencers who have 500K+ followers.

Enter the Micro (and even Nano) influencer — they’re more affordable, and in some cases, may be open to working with you on an ongoing basis.

Bonus: rather than paying only one Macro influencer, you can work with a few Micro influencers for a campaign or launch — reaching multiple communities and voices.

Benefit #2: Micro Influencers Have Niche Communities

Compared to Macro influencers, Micro influencers have a smaller, yet more targeted audience.

Many talk about one to three topics (a niche) which allows them to connect with their community and know their followers well — similar to a friend or trusted confidante.

So, when it’s time to recommend a product or brand, the response will often be overwhelmingly positive.

Benefit #3: Micro Influencers Are Creative

One word: personalization.

Micro influencers know their audience well, making them experts in knowing what will (and won't) work for a brand partnership.

Rather than telling the influencer exactly what to say or do, hand over the reigns and let them tap into their creativity and unique voice.

Not only does this take the weight off of brands — it allows for a more authentic and genuine endorsement. An ultimate win-win.

Benefit #4: Micro Influencers Have High Engagement Rates

As it turns out, the less followers an influencer has, the higher their average engagement rate.

According to TechJury, Instagram Micro influencers have an average engagement rate of 6% — compared to Macro and Mega influencers who receive much less.

The takeaway? With steady engagement rates, supportive communities, and fees that better align with small business budgets, partnering with Micro influencers is a no-brainer marketing strategy.

P.S. With Later's influencer marketing tools, you can find tons of Nano and Micro creators for your next big campaign.

3 Brands That Work with Micro Influencers

Need inspo? We’ve got you. Here are a few Micro influencer marketing campaigns to spark ideas for your future partnerships:

Marlow

Supergoop

Mejuri

#1: Marlow

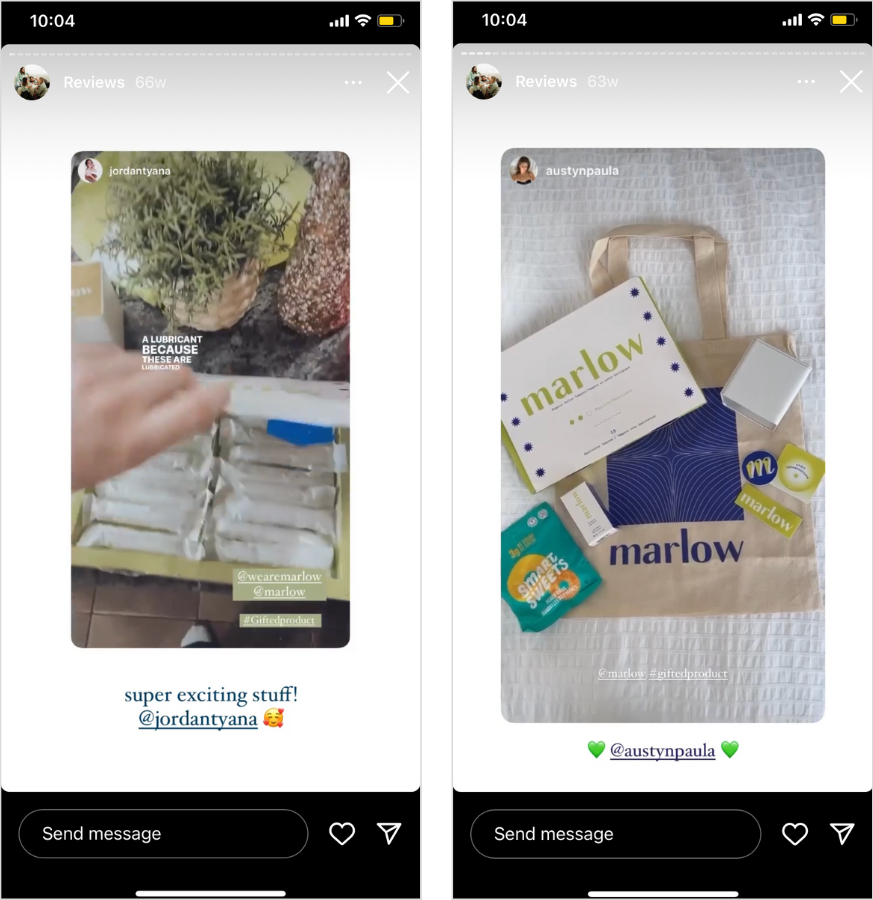

As the creators of "tampons for people who hate tampons," Marlow is a menstrual and sexual wellness brand changing the game for menstruators everywhere.

With just over 4K Instagram followers, Marlow often partners with Micro influencers via Stories to spread the word about their mission.

They even have a dedicated Stories Highlight to showcase their collaborations:

#2: Supergoop

Supergoop takes SPF seriously. Of equal importance? Influencer marketing.

While the brand has long term partnerships with well-known Mid and Macro creators like Tashi Rodriguez and Abbey Yung, they often partner with Micro influencers too.

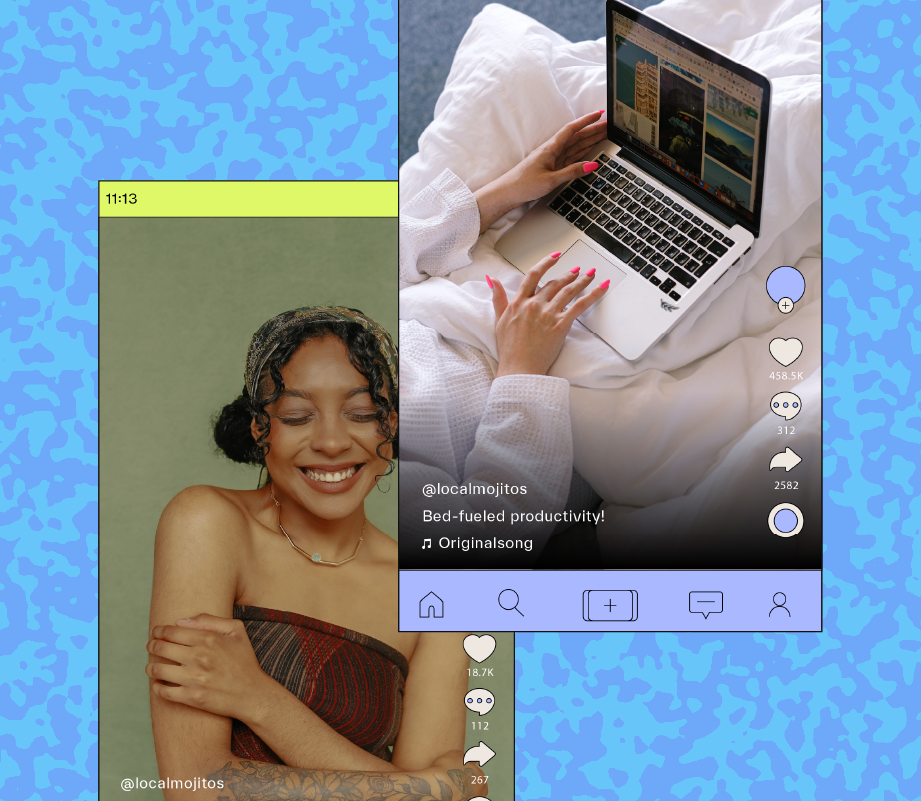

Check out this sponsored post from The Glow Scout on TikTok that racked up 2.8K+ likes and over 80 intrigued commenters:

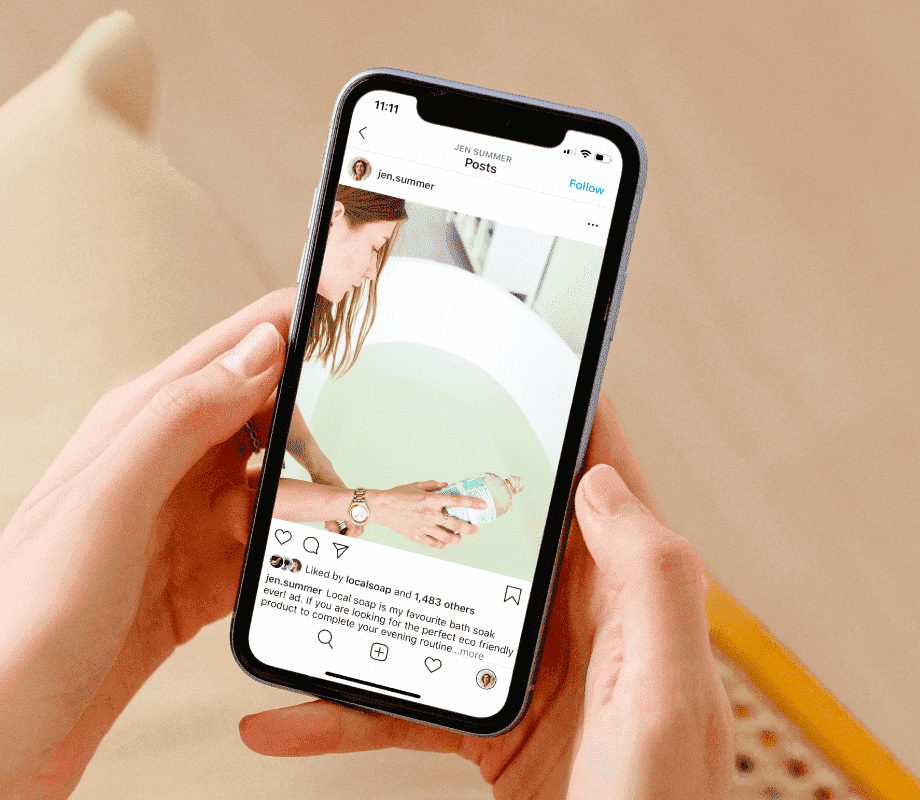

#3: Mejuri

Mejuri is the definition of a Micro influencer marketing success story.

In their early days, the fine jewelry brand used an affiliate marketing program where they sent Nano and Micro influencers free products to promote on Instagram.

While the brand has seen massive success since, Micro influencers can still be seen rocking Mejuri in sponsored content:

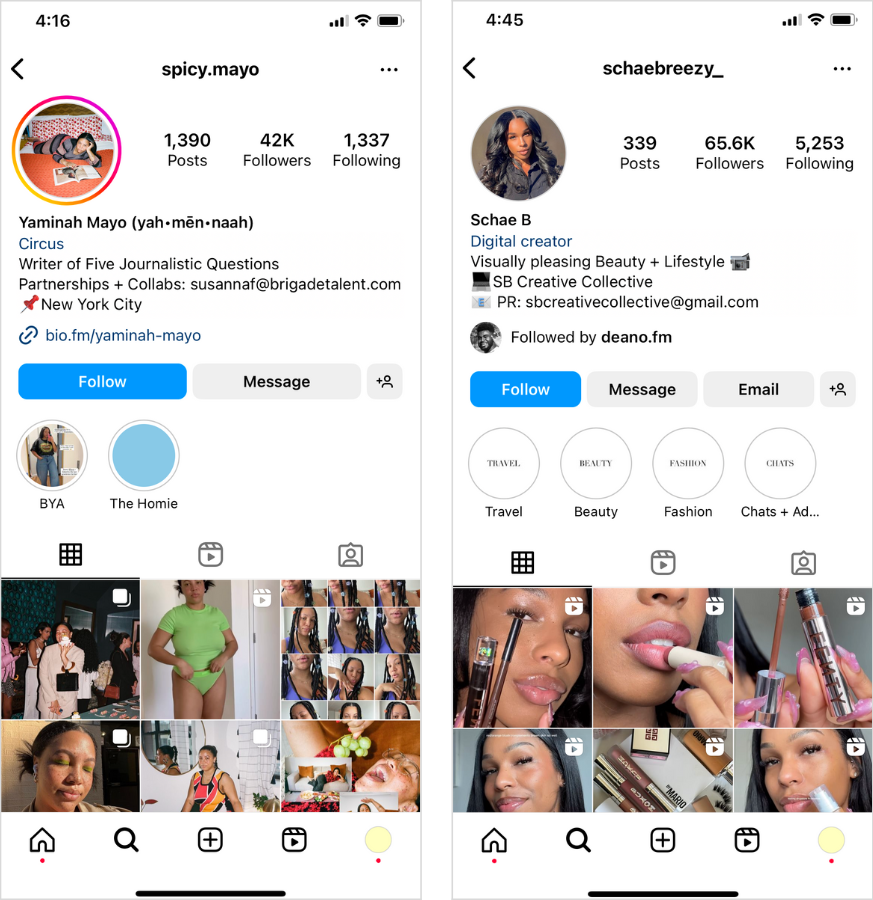

Who Are Popular Micro Influencers?

While there are thousands of Micro influencers you can work with, here are three notable Micro creators currently killing it on social media:

Angela Onuoha

Melanie Laurene

Ben Courtice

#1: Angela Onuoha

Angela Onuoha is the perfect example of a Micro influencer who’s built a community of beauty-lovers through her expert skincare and hair tutorials.

So, when she recommends a product to her community of 96K+ Instagram followers, they know it’s the real deal.

#2: Melanie Laurene

Melanie Laurene, better known to her followers as an “Internet big sis,” is the true definition of comfort content.

With just over 11K Instagram followers, Melanie’s mental health and self-care content shines as bright as she does.

#3: Ben Courtice

Known as “Boring Friends,” Ben Courtice is a multidisciplinary graphic designer who often shares his design process, pro tips, and all around good vibes.

With 83K+ TikTok followers and steady engagement on the platform, Ben’s work is proven to be just as creative as his engagement strategy.

How to Find Micro Influencers to Work With

Ready to kick off your first Micro influencer marketing campaign? Here are four steps to find Micro influencers to work with:

Outline Your Goals and Expectations

Find and Verify Potential Micro Influencer Partners

Negotiate Fees

Create an Influencer Agreement Contract

Track and Monitor Results

Step #1: Outline Your Goals and Expectations

Before you start working on your campaign, the first step is to set your goals and define what metrics will be essential to measuring success.

Do you want to increase traffic to your website? Drive sales with a promo code or affiliate link? Raise brand awareness?

This will help guide the kind of Micro influencers you may want to work with and what deliverables to ask for.

TIP: Make sure you set a budget during the planning stage, too.

Step #2: Find and Verify Potential Micro Influencer Partners

The best Micro influencer partners are those who align with your target audience and brand.

You should ideally work with niche influencers who have high engagement rates, post consistently, and have a distinct personality or voice.

Here are a few ways you can find and verify influencers for your next campaign:

#1: Pay attention to your social media comments and tags

If someone is actually a fan of your brand, it will feel like a natural collaboration when they promote your products to their followers.

#2: Monitor your branded hashtag

Similar to comments and tags, if a Micro influencer frequently uses your branded hashtag, they likely have a genuine passion for your business and will be keen to partner on a campaign.

#3: Use third-party influencer tools

Tools like Later Influence — an influencer marketing platform — can help you easily discover and connect with creators and influencers.

Step #3: Negotiate Fees

Now that you’ve identified a few Micro influencers you’d like to work with, it’s time to talk money.

Most influencers will provide a rate card or a media kit with rates included.

As we discussed earlier, rates can fluctuate — so be ready to negotiate a fee based on your budget and expected deliverables.

Step #4: Create an Influencer Agreement Contract

When the fee has been agreed upon, you’ll need to create a contract with all relevant information, including things like payment, briefing materials, and content deliverables.

Once the finer details are settled, content creation awaits.

Step #5: Track and Monitor Results

It’s important to track, monitor, and measure the results of your campaign.

This way, you can see how the content performed and use it to inform future campaigns — whether it’s working with the same Micro influencers, finding new ones, or setting up different goals.

TIP: Later’s Analytics tool is the simplest way to track in-depth data in one easy-to-use dashboard 🙌

And that’s that — your guide to Micro influencer marketing in 2023.

With these tips and inspo, you’re bound to create a partnership that steers the right audience in your brand’s direction.