Good news: with a projected value of $22.2B by 2025, influencer marketing remains a top marketing strategy for brands.

So, as you explore this marketing powerhouse, it helps to have the latest trends in your back pocket.

How is AI affecting the industry? What are in-house influencers? How are brands tapping into exclusive content?

We’ll cover all this and more with our top influencer marketing trends to watch in 2024.

P.S. If video is more your speed, watch our free on-demand webinar to hear industry leaders discuss their influencer marketing predictions. Sign up now!

Table of Contents

- #1: Brands Go All-in on TikTok

- #2: LinkedInfluencers Take Off

- #3: AI Influencers Enter the Chat

- #4: Brands Invest In Employee "Influencers"

- #5: Exclusive Content

- #6: Affiliate Marketing Programs

- #7: Influencer Content Turned Paid Ads

- #8: Pay Transparency

- #9: Influencers Turned Business Owners

- #10: Popularization of “Stock Content”

- #11: Less Filters & Curation

- #12: UGC Creators Soar

- #13: Comeback of Long-form Content

- #14: More Ongoing Partnerships & Collaborations

- #15: Influencers Get More Creative Control Over Branded Content

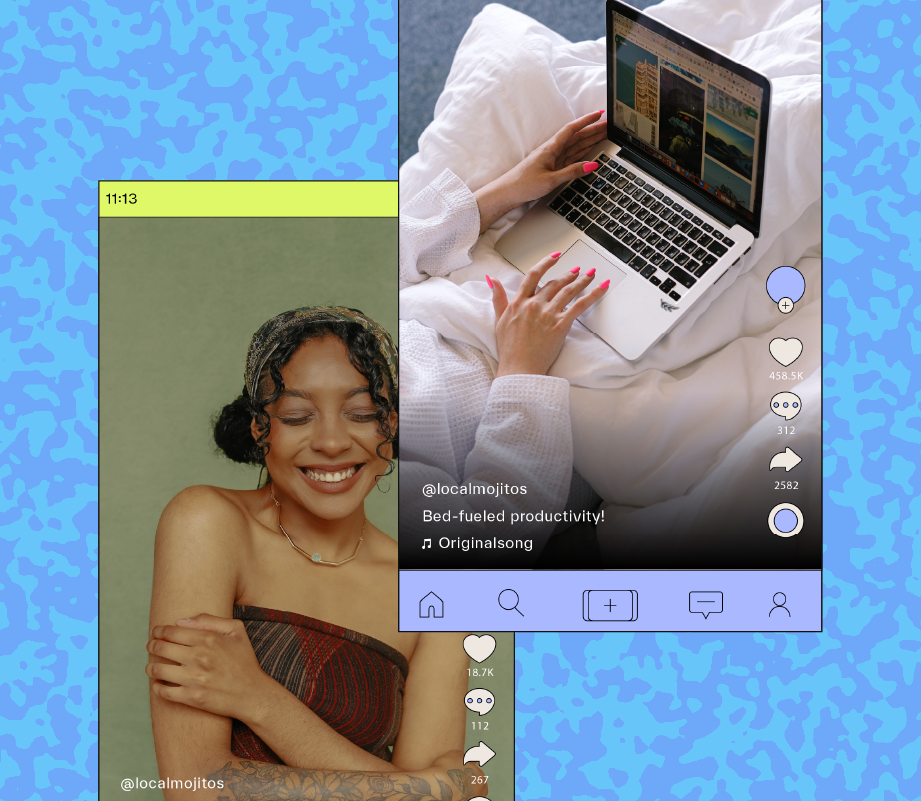

#1: Brands Go All-in on TikTok

Our top trend for 2024? TikTok is the place to be.

Case in point: TikTok had an estimated 33.3M US social buyers at the end of 2023.

Coupled with the launch of TikTok Shop, brands are seeing more sales and ROI on this platform by a landslide.

The takeaway? It’s easier than ever to get discovered and secure buyers on TikTok — and we’ll see more brands capitalize on the opportunity in 2024.

FYI: Later Influence™ is an all-in-one influencer marketing solution trusted by enterprise brands to grow and manage their creator programs — including on TikTok. Learn more.

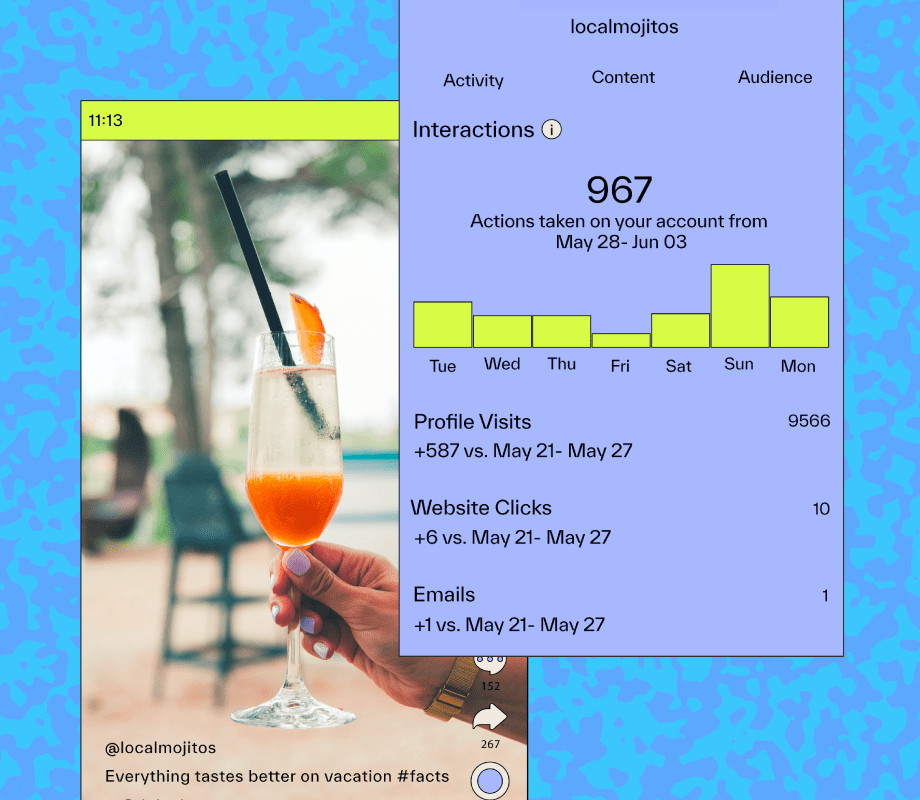

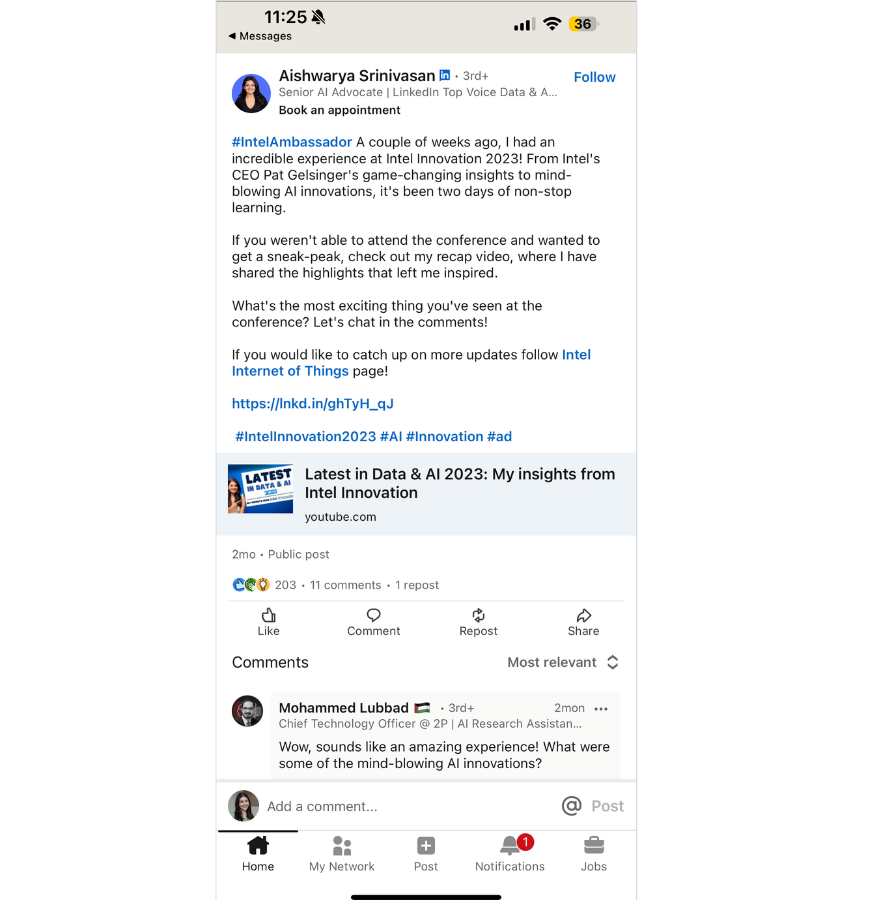

#2: LinkedInfluencers Take Off

LinkedIn had its moment in 2023, but 2024 is where it’ll really take off.

We’re talking more LinkedIn creators (AKA "LinkedInfluencers"), more sponsored posts, and more monetization opportunities from mega brands like Intel:

Our two cents?

Creators on X (previously Twitter) will migrate their primary platform to LinkedIn, bringing on a whole new wave of opportunities for collaborations.

P.S. We saw this coming… read: LinkedIn Influencers: Who They Are & How To Become One.

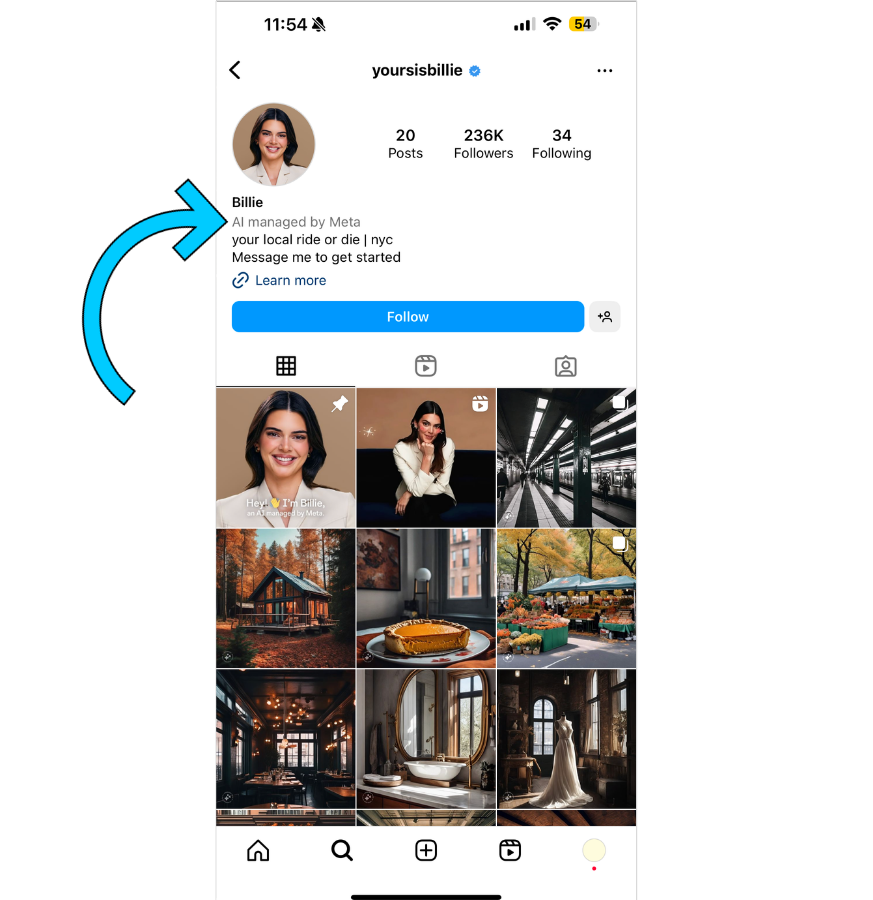

#3: AI Influencers Enter the Chat

Remember virtual influencers?

Introducing: AI-generated influencer personas powered by Meta — the latest AI phenomenon sweeping social media.

Kendall Jenner, Snoop Dogg, and Paris Hilton are among the first to sell their likeness to create personas on WhatsApp, Messenger, and Instagram that users can chat with via DM.

Their purpose? To make AI feel more familiar, spark authentic conversations, and influence everyday decisions.

Have these parasocial relationships gone too far? Will brands use the technology for marketing campaigns? What impact will this have on IRL influencers?

We’ll keep you posted.

#4: Brands Invest In Employee "Influencers"

In 2022, we saw brands hire creators to lead their brand strategy.

Now, two years later, we predict more employees will become ambassadors for the brands they work for.

Not to be confused with influencers hired as social media managers, creators like Brandon Nguyen showcase new items, answer questions, and share purchasing information — all from their “personal” account.

With 100K+ followers and a combined 7.6M+ likes on TikTok, we predict brands will be inspired by accounts like Brandon’s and jump on the trend in 2024.

ICYMI: Get in-depth insights about influencer marketing in our free on-demand webinar. Watch now.

#5: Exclusive Content

In 2024, your favorite creators may reside behind a paywall.

We predict a rise in popularity with the usage of “close friends features”, ticketed community meet ups, and podcast or newsletter launches.

We just might see brands partner with the likes of Patreon creators and other monetized influencers for exclusive discounts and product sneak peeks in 2024.

One thing is for sure – we’ll see more creators moving beyond posting on social and creating multiple revenue streams.

#6: Affiliate Marketing Programs

The affiliate marketing industry is expected to reach $36.9B by 2030.

So, if your brand isn’t capitalizing on affiliate marketing in 2024, you’re missing out on the ultimate hack for cost-effective, continuous leads.

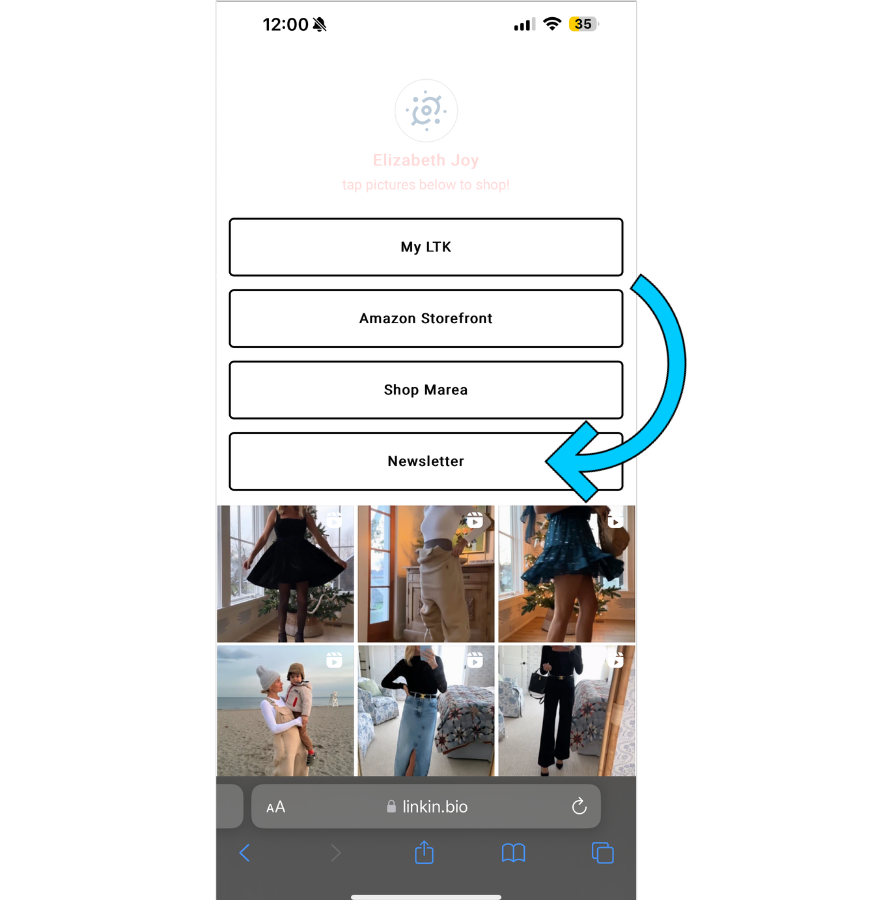

With Amazon storefronts and LTK landing pages front and center, we predict more brands will launch their own affiliate programs to drive brand awareness, enhance social proof, and get a bigger bang for their buck.

Learn all the need-to-knows about affiliate marketing in this blog post: Everything You Need to Know About Instagram Affiliate Marketing.

#7: Influencer Content Turned Paid Ads

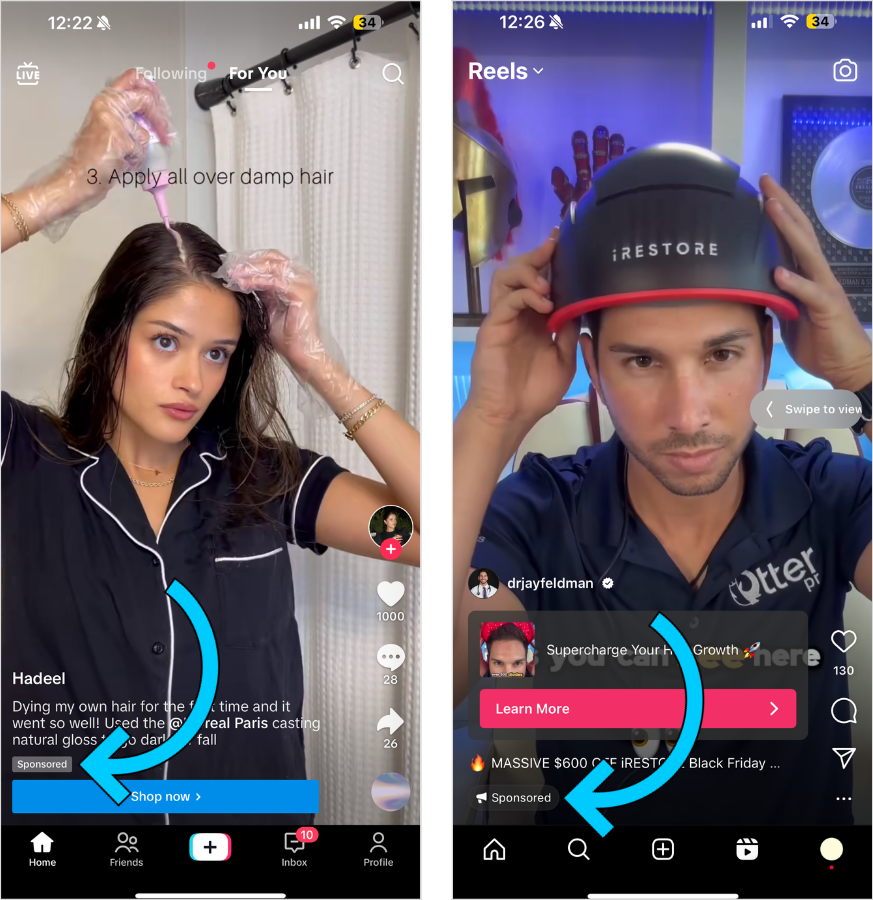

A top priority for brands in 2024? Getting the most out of their influencer marketing partnerships.

This means prioritizing quality content that can be repurposed for web pages or paid ads to increase conversions and engagement.

We’ll see more brands regularly include paid ad content in their initial contracts to target niche(r) audiences with organic-looking content.

So, influencers — read your contracts thoroughly. And brands — prepare to allocate a bigger budget per campaign.

FYI: Later's influencer marketing platform is trusted by top brands to discover creators, manage campaigns, and more. Schedule a call today.

#8: Pay Transparency

Unfortunately, the answer isn’t black and white when it comes to how much influencers actually make.

Rates aren’t distributed fairly, and with little transparency into how much (and if) brands pay, it can be difficult for influencers to understand their monetary value.

In 2024, discussions of pay continue to be at the forefront of the creator economy, with platforms like Clara for Creators and FYPM helping creators get candid about their experiences.

Our prediction?

More tools and platforms will launch to help both influencers and brands in 2024 — bringing even more pay transparency and an industry standard for base rates.

In the meantime, check out free Later’s Creator Rates Report for influencer insights into how much creators are charging.

#9: Influencers Turned Business Owners

One trend we’ve noticed more and more in the influencer marketing industry is the creation of full-fledged entrepreneurs.

While being an influencer is its own full-time (or part-time) job, we’re talking about those who’ve leveraged their influence into their own businesses.

What does this mean for brands? It opens up a world of opportunities for partnerships.

If you have an upcoming campaign, consider partnering with the influencer's account and their brand account for a giveaway or collaboration.

Being able to leverage their business — when it makes sense — can be mutually beneficial for you both.

Plus, judging by Forbes’ Top Creators list, entrepreneurship is top-of-mind… We’ll leave you with that.

#10: Popularization of “Stock Content”

Between building an engaged community, partnership obligations, and simply being human — it’s unrealistic for influencers to create fresh content every day.

That’s where stock content comes in — or as entrepreneur Natasha of @shinewithnatasha describes it, “B-roll footage for low-lift high-impact content.”

“I have an entire folder of ready-to-create videos for when I want to show up but can’t be bothered to talk on camera or perfectly master a lip sync trend,” Natasha explains in her Reels caption.

It’s as simple as creators filming themselves making a cup of coffee or walking down the street in their OOTD.

With ready-to-go videos and photos, creators can prioritize their mental health and spend more time building relationships with followers. Win-win.

Learn from creators about how your brand can support their mental health: Creator Mental Health & Burnout (+ Free Report).

#11: Less Filters & Curation

Perfectly imperfect content is the new wave on social media, and it’s become a growing influencer marketing trend too.

Creators are shifting away from the flawless curated feed aesthetic, and choosing to share less filtered and more in-the-moment content.

Think: Instagram photo dumps and vlogs on TikTok.

One community who’s nailed this trend? BookTok creators.

Take Kendra who seamlessly promotes books in chill, authentic videos:

Feels like a FaceTime call with a friend, doesn’t it?

The takeaway? Don’t worry so much about finding influencers who have the “perfect” aesthetic in 2024.

#12: UGC Creators Soar

Last year, we predicted that UGC creators would become just as valuable as traditional influencer partnerships to drive sales and traffic.

And we were right — according to Forbes, over 86% of companies use user-generated content (UGC) as part of their marketing strategy.

Why? UGC is typically seen as more trustworthy than branded advertising, can help build credibility of your product, and is great for building a feed full of beautiful content.

In 2024, we think UGC creators will no longer be unicorns.

With no need for tons of followers or the obligation to show their face, more and more seasoned (and aspiring) influencers will help brands build a bank of UGC content year-round.

PSA: Later is a social media planning and scheduling platform trusted by 7M+ brands to find and curate UGC. Create an account today.

#13: Comeback of Long-form Content

TikTok raised their video length to 10 minutes in 2022, and it's rumored to become 15 minutes soon — proving long-form content is here to stay.

From vlogs to educational content, prominent niches like the makeup community are creating longer videos for TikTok and Reels:

Are users growing tired of quick and fast trends? Will influencers turn to creating more in-depth and "episodic" content? And what does this mean for platforms like YouTube?

We'll circle back.

#14: More Ongoing Partnerships & Collaborations

This trend held strong in 2023, and we predict it’ll continue in 2024.

Rather than a one-off post or video, influencers will be looking to partner with brands on a more ongoing basis.

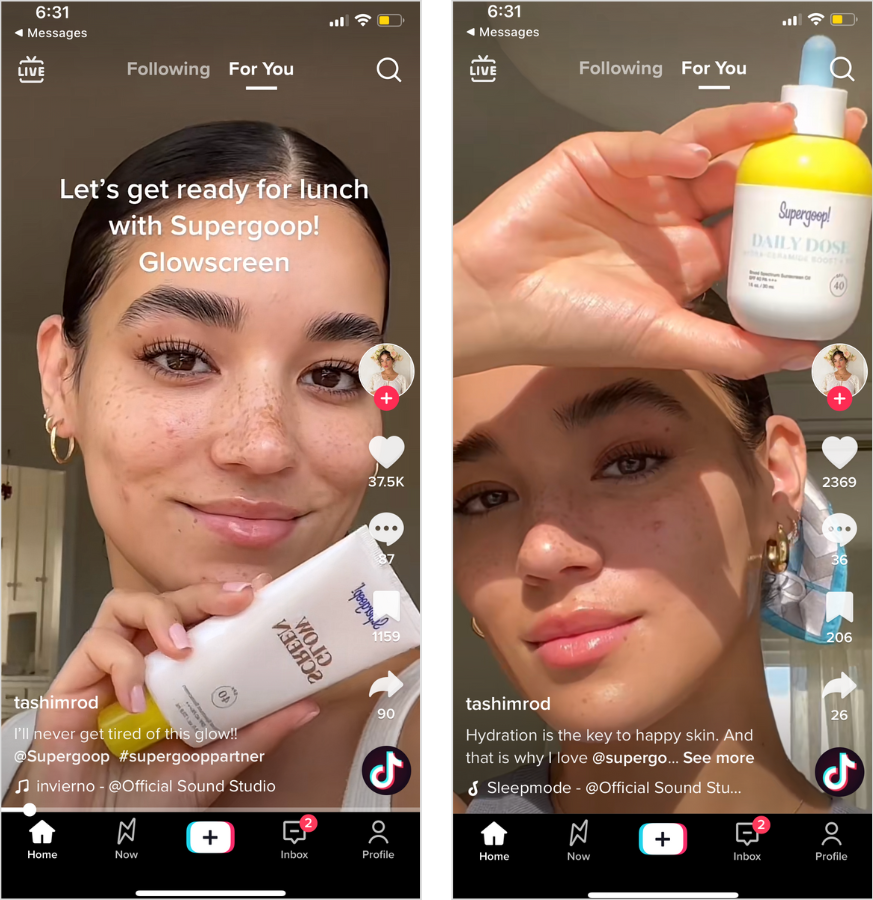

Take Tashi whose love for SPF brand Supergoop is apparent throughout her sponsored content:

She even uses their products in non-sponsored posts — making the partnership feel more authentic:

Investing in a long-term relationship is a win-win for both parties.

Not only does it build trust with the influencer’s community, but it adds a level of legitimacy. Plus, it’ll drive sales!

#15: Influencers Get More Creative Control Over Branded Content

As the influencer space grows and algorithms change, Influencer Marketing Manager Kurtis Smeaton says it’s more important than ever to give influencers creative control.

“The more authentic the endorsement, the more genuine the partnership feels,” Kurtis says.

“Creators know their audience far better than we do — we need to trust that.”

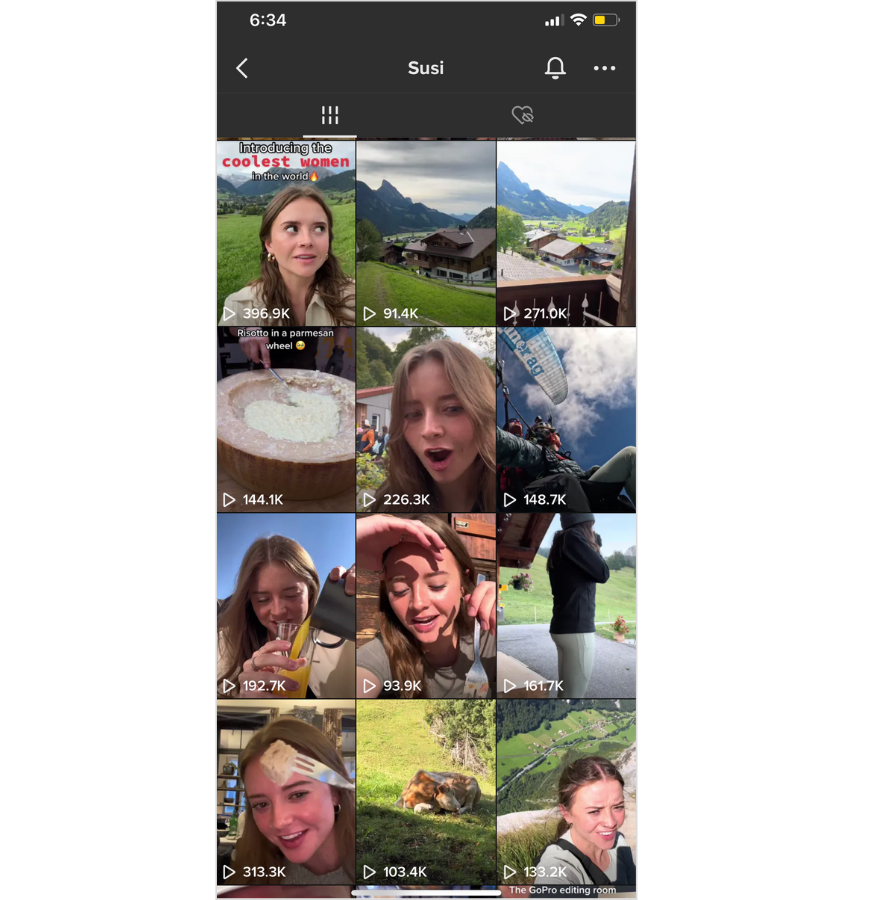

Proof: GoPro sent 42 creators on the trip of a lifetime to Interlaken, Switzerland without any content obligations, and the results were as thrilling as the content:

Because they chose relevant creators and let them be themselves, GoPro racked up thousands of views showing off their new equipment.

Our advice for 2024? Go with a collaborative approach rather than a prescriptive one — and watch how your partnerships change for the better.

Plus, you can plan, manage, and analyze the results of your partnerships with Later's influencer marketing solutions!

There’s no doubt we will see exciting creative influencer marketing trends in the industry for years to come — and you can count on us to keep you in the loop.